Zoho CRM for insurance agents unlocks unparalleled efficiency, transforming how you manage clients, streamline sales, and excel in the industry. This comprehensive guide delves into the powerful features of Zoho CRM, tailored specifically for insurance professionals, to help you optimize your workflows and achieve greater success.

Imagine effortlessly managing client interactions, tracking leads with precision, and automating crucial tasks. Zoho CRM’s user-friendly interface and customizable features allow you to tailor the platform to your unique needs, empowering you to focus on what truly matters – building strong client relationships and driving growth.

Introduction to Zoho CRM for Insurance Agents

Zoho CRM offers a comprehensive suite of tools designed to streamline various aspects of insurance agent operations. This platform empowers insurance agents to manage client interactions, track leads, and ultimately boost productivity and profitability. The intuitive interface and robust features make Zoho CRM a valuable asset for insurance agents seeking to optimize their workflows and enhance customer relationships.

Yo, insurance agents, check out Zoho CRM. It’s like, totally fire for managing clients and everything. But, like, are you wondering if insurance will cover, like, gynecomastia surgery? You gotta peep this can gynecomastia surgery be covered by insurance article. Once you know that, Zoho CRM will help you keep track of everything, from quotes to claims.

It’s a total game-changer, fam.

Core Features Relevant to Insurance Agents

Zoho CRM’s core features provide insurance agents with a centralized hub for managing all aspects of their business. These features are specifically designed to address the unique needs of insurance agents, from lead generation to policy renewals. Crucially, the system allows for a comprehensive view of customer interactions, enabling personalized service and improved client retention. This holistic approach allows agents to nurture leads effectively and convert them into paying customers.

Streamlining Insurance Agent Workflows

Zoho CRM streamlines workflows by automating tasks, such as lead assignment, follow-up reminders, and policy renewals. This automation significantly reduces manual effort and frees up agents to focus on building relationships with clients. The platform’s ability to integrate with other systems further enhances efficiency, enabling agents to access crucial information in real-time. This seamless integration with existing systems allows for a smooth transition and reduced learning curve.

Yo, Zoho CRM is like, totally fire for insurance agents, you know? Keeps everything straight, no cap. Plus, it’s lit to see how State Farm is supporting these twin basketball players, state farm twin basketball players. They’re killin’ it on the court, and that’s seriously inspiring. Back to Zoho, though, it’s a game-changer for agents trying to manage their clients and deals, right?

Benefits of Managing Client Interactions with Zoho CRM

Using Zoho CRM for managing client interactions yields several key benefits. Firstly, it fosters a more organized and efficient approach to client communication. Secondly, it enhances client satisfaction by enabling agents to respond promptly to inquiries and address concerns effectively. This proactive approach strengthens relationships and cultivates customer loyalty. Furthermore, the detailed record-keeping within Zoho CRM provides a historical context for client interactions, allowing for a personalized approach to future engagements.

Zoho CRM Modules for Insurance Agencies

This table Artikels various Zoho CRM modules applicable to insurance agencies, showcasing their specific use cases.

| Module | Use Case |

|---|---|

| Leads | Capture and manage potential clients, categorize leads based on specific criteria (e.g., type of insurance, coverage needs), and track interactions throughout the sales process. |

| Contacts | Store detailed information about clients, including policy details, contact history, and preferences. |

| Accounts | Manage client accounts, including policy details, payment information, and renewal dates. |

| Opportunities | Track sales opportunities, including the potential value of each policy and the probability of closing the deal. |

| Activities | Schedule and track appointments, calls, emails, and other interactions with clients, enabling agents to maintain a detailed record of their interactions. |

| Reports & Dashboards | Generate reports on sales performance, client interactions, and other key metrics. This data-driven insight allows agents to monitor their progress and adjust strategies as needed. |

Client Management and Relationship Building

Zoho CRM empowers insurance agents to cultivate strong client relationships and effectively manage a substantial client base. It provides a centralized platform for storing and accessing comprehensive client information, streamlining communication, and fostering deeper connections. This detailed approach to client management translates to improved customer satisfaction and ultimately, increased profitability.Maintaining detailed client records is crucial for insurance agents.

Zoho CRM allows for the creation of extensive profiles that encompass crucial information, including contact details, policy specifics, and even past interactions. This comprehensive data repository empowers agents to swiftly access pertinent information, fostering efficient service and building trust with clients.

Detailed Client Records

Zoho CRM’s robust client record-keeping system facilitates the creation of detailed client profiles. Fields can be customized to capture vital information, enabling a thorough understanding of each client’s needs and preferences. This includes not only contact details but also policy details, claim history, and any special requirements or preferences. This detailed view allows agents to personalize their interactions and proactively address client concerns.

Tracking Client Interactions, Zoho crm for insurance agents

Zoho CRM effectively tracks client interactions, including calls, emails, and meetings. Agents can log every interaction, including notes, attachments, and outcomes. This creates a comprehensive history of each client interaction, offering a valuable resource for future reference and proactive service. For instance, if a client calls regarding a specific policy, the agent can quickly access previous interactions to understand the client’s needs and respond efficiently.

Comparison with Other CRM Options

Zoho CRM stands out in its client relationship management capabilities, particularly for insurance agents. While other CRMs offer contact management, Zoho CRM provides a more comprehensive platform for insurance-specific needs. Its intuitive interface and customizable fields allow agents to tailor the system to their specific workflows, unlike some competitors that might require extensive training or customization. Zoho’s robust reporting and analytics tools further enhance its appeal.

Client Segmentation

Efficient client segmentation is key to targeted marketing and personalized service. Zoho CRM provides the tools to segment clients based on various criteria.

| Segmentation Criteria | Zoho CRM Fields | Example Usage |

|---|---|---|

| Policy Type | Policy Type, Premium Amount | Identify clients with high-value life insurance policies for targeted premium renewal offers. |

| Location | Address, Zip Code | Tailor marketing campaigns to clients in specific geographic areas. |

| Policy Tenure | Policy Start Date, Policy End Date | Identify clients nearing policy renewal for proactive communication. |

| Claim History | Claims filed, Claim amounts | Segment clients based on claim frequency to offer preventive measures or enhanced support. |

| Customer Value | Policy value, Annual premium | Identify high-value clients for exclusive VIP services or personalized offers. |

This structured approach to segmentation ensures targeted outreach and personalized service, maximizing the value of each client interaction.

Sales and Lead Management: Zoho Crm For Insurance Agents

Zoho CRM empowers insurance agents to efficiently manage their sales pipeline and nurture leads, ultimately converting them into loyal clients. A robust lead management system within Zoho CRM is crucial for success in today’s competitive insurance market. Effective lead management directly impacts an agent’s bottom line and long-term growth.Zoho CRM provides a comprehensive platform for insurance agents to streamline their sales processes, from initial contact to policy issuance.

This approach allows for improved client retention and stronger agent-client relationships. The system allows for detailed tracking of sales activities, facilitating a clearer understanding of sales performance and identifying areas for improvement.

Lead Generation Strategies in Zoho CRM

Zoho CRM’s robust lead generation features allow agents to capture potential clients effectively. These features include automated lead capture forms, integration with marketing automation tools, and targeted campaigns. By combining these tools, agents can build a strong pipeline of qualified leads. Furthermore, utilizing social media platforms and online advertising, in conjunction with Zoho CRM, allows agents to capture prospects and expand their reach.

Converting Leads into Paying Clients

A key aspect of successful lead management is the conversion process. A structured approach to lead nurturing is essential. This involves engaging with leads through personalized communications, providing valuable information, and demonstrating expertise. For instance, tailored email sequences, strategically timed follow-ups, and informative content (e.g., blog posts, webinars) can help move prospects through the sales funnel.

Common Sales Challenges and Zoho CRM Solutions

Insurance agents often face challenges such as maintaining contact with numerous leads, tracking interactions, and ensuring timely follow-ups. Zoho CRM’s features address these challenges by providing a centralized platform for managing all client interactions. The platform allows for automated reminders, personalized communication templates, and detailed interaction histories. Moreover, effective reporting and analytics features within Zoho CRM provide insights into sales performance, helping agents identify areas for improvement.

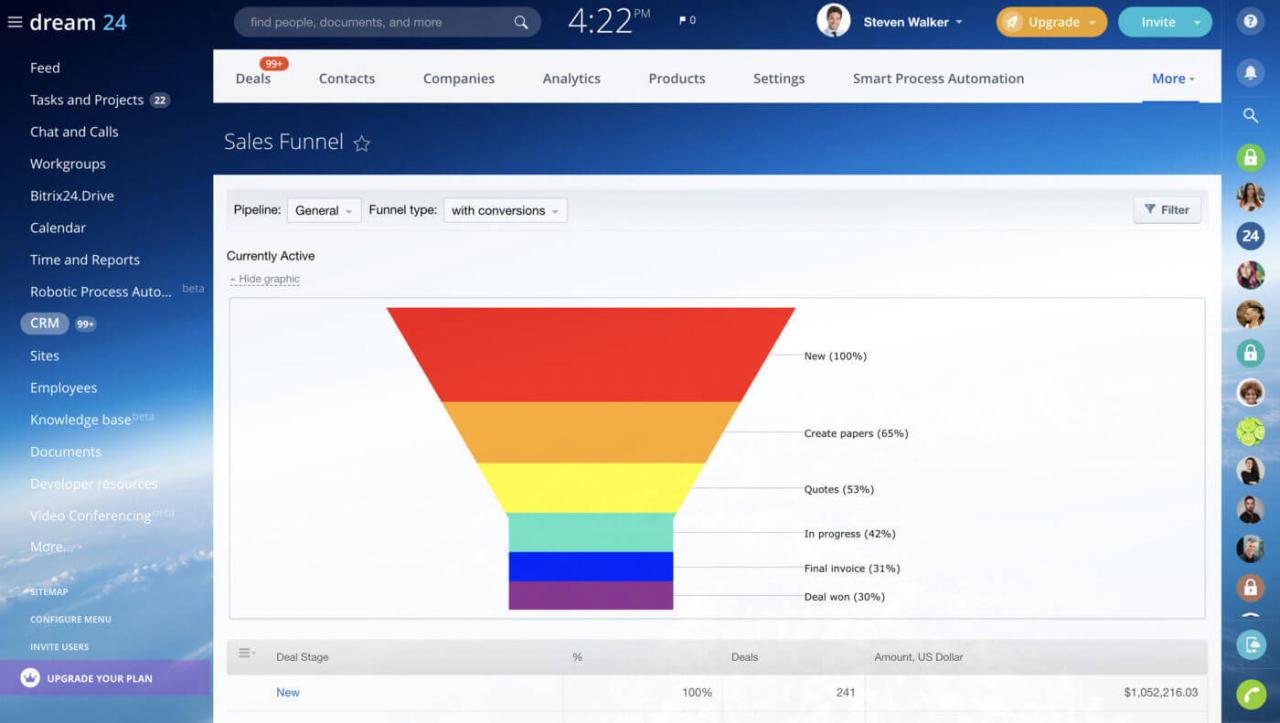

Tracking Sales Activities and Performance

Zoho CRM offers detailed tools for tracking sales activities and measuring performance. Agents can log calls, emails, meetings, and other interactions with leads and clients. These records are stored within the CRM, providing a comprehensive view of the sales process. Detailed reporting features provide metrics such as conversion rates, average deal size, and sales cycle length. This data enables agents to analyze their performance and optimize their strategies.

Comparison of Lead Nurturing Strategies

| Feature | Zoho CRM | Other Tools |

|---|---|---|

| Lead Scoring | Zoho CRM allows agents to assign scores based on lead activity and engagement. | Other tools may offer similar lead scoring capabilities or use different criteria. |

| Automated Email Sequences | Zoho CRM’s automation capabilities enable agents to send personalized emails at predefined intervals. | Other tools might have similar features, but Zoho CRM’s integration with other marketing tools provides a more holistic approach. |

| Customizable Workflows | Zoho CRM enables the creation of workflows to automate tasks, from lead qualification to closing deals. | Other platforms may offer workflow automation, but the degree of customization might vary. |

| Integration with Marketing Tools | Zoho CRM seamlessly integrates with various marketing platforms, enabling a unified view of marketing and sales activities. | Some tools might integrate with specific marketing platforms, but a comprehensive integration might require more effort. |

Zoho CRM’s customizable workflows and integration capabilities provide a significant advantage in managing the complex sales cycles of insurance products.

Policy Management and Renewals

Zoho CRM empowers insurance agents to efficiently manage their policy portfolios. This streamlined approach enhances customer relationships and reduces administrative burdens. By centralizing policy data, Zoho CRM facilitates seamless tracking and renewal processes, minimizing the risk of missed payments and lapses.Policy management in Zoho CRM is achieved through the creation of dedicated records for each policy. These records store crucial information like policy details, customer data, premium amounts, and due dates.

This centralized storage ensures that all relevant information is readily accessible to agents, enabling proactive communication and service.

Managing Insurance Policies

Zoho CRM’s policy management module allows agents to meticulously track policy details, including coverage types, policy numbers, and associated customer information. Each policy is a distinct record within the CRM system, allowing for comprehensive data management and reporting. This structured approach ensures that no critical information is overlooked, promoting accurate policy servicing and customer satisfaction.

Tracking Policy Renewals and Reminders

Zoho CRM offers robust tools for tracking policy renewal deadlines. Agents can set up automated reminders for approaching renewals, ensuring timely follow-ups with clients. This proactive approach minimizes the likelihood of policy lapses and strengthens customer relationships. Customization options enable agents to tailor reminders to specific policy types or customer preferences.

Automating Policy-Related Tasks

Zoho CRM’s automation features enable agents to streamline policy-related tasks. This includes automating renewal reminders, generating invoices, and sending correspondence. Automation frees up agents’ time, allowing them to focus on client interaction and relationship building. For instance, the system can automatically generate renewal notices, schedule follow-up calls, and send email reminders.

Integration with Insurance Systems

Zoho CRM offers seamless integration capabilities with various insurance-related systems. This integration allows for data synchronization, ensuring that policy information is consistently updated across all platforms. This eliminates data entry errors and enhances the accuracy of policy management. Data consistency is crucial in the insurance industry, and Zoho CRM facilitates this through seamless integration with external systems.

Automating Renewal Reminders in Zoho CRM

| Step | Action | Description |

|---|---|---|

| 1 | Define Renewal Criteria | Establish rules for identifying policies nearing renewal. This might include a specific date range, policy type, or customer segment. |

| 2 | Configure Automated Reminders | Set up reminder notifications based on the defined criteria. These reminders can be sent via email, SMS, or other communication channels. |

| 3 | Schedule Reminders | Choose the frequency and timing of reminders to effectively alert clients and agents. |

| 4 | Track Reminder Effectiveness | Monitor the response to automated reminders to ensure their efficacy and make necessary adjustments. This allows agents to gauge client engagement and tailor future interactions accordingly. |

| 5 | Integrate with Invoicing System | Integrate Zoho CRM with an external invoicing system to automate invoice generation for renewal premiums. |

Reporting and Analytics

Zoho CRM empowers insurance agents with powerful reporting and analytics features, providing invaluable insights into their performance and client interactions. These tools allow agents to track key metrics, identify trends, and make data-driven decisions to optimize sales and client relationships. This translates into more effective strategies and ultimately, higher profitability.

Available Reporting Features

Zoho CRM offers a comprehensive suite of reports, enabling agents to delve into various aspects of their business. These reports cover everything from lead generation and conversion rates to policy renewals and customer satisfaction. The dynamic nature of these reports allows for real-time adjustments and immediate responses to changing market conditions.

Actionable Insights from Zoho CRM Reports

Zoho CRM reports provide a wealth of actionable insights for insurance agents. For example, analyzing lead conversion rates reveals bottlenecks in the sales pipeline, enabling agents to implement targeted strategies to improve conversions. Analyzing policy renewal data highlights trends and potential churn risks, enabling proactive intervention to retain valuable clients. Moreover, agent performance reports allow for identifying top performers and areas where support might be needed.

Creating Custom Reports

Zoho CRM facilitates the creation of custom reports tailored to specific needs. Agents can choose from various parameters, including date ranges, specific client segments, and specific policy types, to generate customized reports. This feature is particularly beneficial in providing granular insights into individual client interactions and specific policy performance.

Tracking Agent Performance

Zoho CRM allows for comprehensive tracking of agent performance. Agents can monitor key metrics like lead generation, conversion rates, policy sales, and customer satisfaction scores. This data-driven approach allows for continuous improvement in sales techniques and client management strategies. Analyzing agent performance enables identification of strengths and areas for improvement.

Types of Reports in Zoho CRM

| Report Type | Description |

|---|---|

| Lead Conversion Report | Tracks the progress of leads through the sales pipeline, identifying conversion rates at each stage. |

| Policy Renewal Report | Provides insights into policy renewal rates, highlighting potential churn risks and opportunities for proactive engagement. |

| Sales Performance Report | Summarizes sales performance metrics, including total sales, average deal size, and sales cycle length, by agent. |

| Client Satisfaction Report | Assesses client satisfaction levels based on feedback, surveys, or other interaction data. |

| Customer Segmentation Report | Identifies different customer segments based on specific criteria, allowing for targeted marketing campaigns and personalized client interactions. |

| Policy Value Report | Shows the total value of policies sold by each agent, providing insights into overall revenue contribution. |

Integration and Customization

Zoho CRM’s power lies not just in its core functionality but also in its adaptability. Insurance agents can significantly enhance their efficiency and effectiveness by integrating Zoho CRM with their existing tools and customizing its features to precisely match their workflows. This tailored approach streamlines operations, minimizes manual effort, and ultimately boosts overall productivity.

Integrating Zoho CRM with Other Tools

Zoho CRM offers robust API integrations, enabling seamless connections with a wide array of third-party applications. This integration process allows data to flow effortlessly between systems, eliminating the need for manual data entry and reducing errors. This automated exchange improves data accuracy and consistency, leading to more informed decision-making.

Customizing Zoho CRM Workflows

Zoho CRM’s customization options extend beyond simple interface adjustments. Advanced workflows can be tailored to automate specific tasks, such as policy renewals or claim processing. These customized workflows ensure that critical processes are handled efficiently and consistently, preventing delays and ensuring accuracy.

Examples of Third-Party Integrations

Many insurance agents utilize third-party applications for tasks like quoting, billing, and client communication. Common integrations include those with applicant tracking systems (ATS), billing platforms, and email marketing tools. This integration allows for automated data transfers and centralized information management, streamlining the entire process.

Best Practices for Customizing the Zoho CRM User Interface

A well-designed user interface is critical for efficient agent workflow. Best practices include intuitive dashboards, clear data visualizations, and designated fields for key insurance-related data. This tailored approach fosters user adoption and ensures data is readily accessible and actionable. Visual cues and color-coding can also improve navigation and data interpretation.

Common Zoho CRM Integrations in Insurance

Insurance agents frequently leverage Zoho CRM’s integrations with tools used in the insurance sector. This integration creates a centralized system for managing customer data, policy information, and agent activity. These integrations are essential for streamlining operations and improving overall efficiency.

| Category | Third-Party Tool | Integration Benefit |

|---|---|---|

| Applicant Tracking Systems (ATS) | ApplicantPro, Greenhouse | Automated data transfer for leads and applications, improving lead management and reducing manual effort. |

| Billing Platforms | QuickBooks, Xero | Automated billing and payment processing, reducing errors and improving financial management. |

| Email Marketing Platforms | Mailchimp, Constant Contact | Automated communication with clients, personalized messaging, and improved customer engagement. |

| Quoting and Pricing Systems | InsurTech platforms | Directly integrate policy quoting and pricing information into Zoho CRM, saving time and improving accuracy. |

| Claims Management Systems | Various specialized insurance platforms | Streamline claim processing and reduce delays in the claims cycle, improving customer satisfaction. |

Security and Compliance

Zoho CRM prioritizes the security and compliance needs of insurance agents, recognizing the sensitive nature of the data they handle. Robust security measures are in place to protect client information, ensuring adherence to industry regulations and fostering trust with policyholders. This focus extends to data privacy and facilitates seamless compliance with evolving regulations.

Security Measures in Zoho CRM

Zoho CRM employs multiple layers of security to safeguard sensitive data. These measures include encryption of data both in transit and at rest, access controls based on user roles and permissions, and regular security audits. Data encryption ensures that even if unauthorized access is gained, the information remains unreadable without the proper decryption key. These protocols are continuously updated to adapt to evolving cyber threats.

Compliance Features Relevant to the Insurance Industry

Zoho CRM incorporates compliance features crucial for the insurance industry. These features address data privacy regulations like GDPR and CCPA, and specific insurance industry requirements. The platform facilitates the tracking of sensitive data in compliance with applicable regulations, ensuring adherence to industry standards and best practices. Zoho CRM provides tools to meet specific insurance industry requirements, such as maintaining detailed audit trails of all actions taken on client records.

Ensuring Data Privacy and Security within Zoho CRM

Data privacy and security within Zoho CRM are ensured through a combination of robust security measures and user-centric policies. These policies cover data access restrictions, data retention procedures, and data breach response plans. Regular training and awareness programs for users help maintain vigilance against security threats and compliance issues. Users are trained on the importance of adhering to security protocols and data privacy regulations.

Industry-Specific Compliance Features in Zoho CRM

Zoho CRM’s compliance features extend beyond generic security measures. The platform provides specific features for insurance companies, enabling them to meet industry-specific regulations. These include granular control over access to client data, automated compliance reporting, and the ability to track policy renewals and modifications in a secure manner. The software enables adherence to various insurance regulations, promoting a secure and trustworthy environment for both the company and its clients.

Table of Security and Compliance Features in Zoho CRM for Insurance

| Feature | Description | Benefit |

|---|---|---|

| Data Encryption | All data is encrypted both in transit and at rest. | Protects sensitive information from unauthorized access. |

| Role-Based Access Control | Users are granted access based on their roles and responsibilities. | Ensures only authorized personnel can access specific data. |

| Audit Trails | Detailed logs of all actions on client records. | Facilitates compliance with regulations requiring activity tracking. |

| GDPR/CCPA Compliance | Features support compliance with data privacy regulations. | Ensures adherence to data privacy requirements for EU and US clients. |

| Insurance-Specific Reporting | Customizable reports tailored to insurance industry needs. | Enables the generation of reports specific to policy renewals, claims, etc. |

Training and Support

Mastering Zoho CRM for insurance agents requires a strong foundation in its features and functionalities. Comprehensive training and readily available support are crucial for maximizing the platform’s potential and achieving optimal results. Effective use of Zoho CRM empowers agents to manage client relationships, streamline sales processes, and improve overall operational efficiency.

Available Training Resources

Zoho provides a wealth of resources to help insurance agents learn and utilize Zoho CRM effectively. These resources cater to different learning styles and experience levels, ensuring a smooth transition for all users.

- Online Tutorials and Documentation: Zoho’s extensive online documentation features step-by-step tutorials, video guides, and FAQs. These resources offer detailed explanations of various Zoho CRM functionalities, including lead management, policy management, and reporting tools. This extensive online library allows agents to learn at their own pace and revisit information as needed.

- Interactive Webinars and Workshops: Zoho frequently hosts webinars and workshops tailored to the specific needs of insurance agents. These interactive sessions offer practical demonstrations, real-world case studies, and Q&A opportunities to address agent-specific concerns.

- Community Forums and Support Groups: Engaging with a community of Zoho CRM users through online forums and support groups offers a platform for peer-to-peer learning and knowledge sharing. Agents can ask questions, share best practices, and learn from others’ experiences.

Support Materials

Access to comprehensive support materials is essential for effective Zoho CRM utilization. These materials ensure agents can overcome challenges and troubleshoot issues efficiently.

- Help Center: The Zoho Help Center provides readily accessible FAQs, troubleshooting guides, and articles covering various CRM functionalities. These resources address common problems and provide solutions, reducing the need for direct support inquiries.

- Knowledge Base: The Zoho Knowledge Base is a comprehensive repository of articles and documents outlining CRM features, functionalities, and best practices. This centralized knowledge base ensures agents have quick access to pertinent information.

- User Manuals: Detailed user manuals provide in-depth explanations of specific CRM features and functionalities. These manuals serve as valuable resources for understanding the platform’s capabilities and optimizing its use for insurance-specific needs.

Importance of Ongoing Support

Ongoing support is critical for Zoho CRM users. It helps agents stay up-to-date with new features, address technical issues, and maintain optimal CRM performance. Continuous support ensures agents leverage the platform effectively and maximize its potential to improve productivity and business outcomes.

Support Channels

Several support channels are available to assist Zoho CRM users. Choosing the appropriate channel ensures timely resolution of issues and facilitates efficient problem-solving.

- Zoho Customer Support Portal: This portal offers access to self-service resources, knowledge bases, FAQs, and direct contact with Zoho support representatives. This channel enables agents to resolve many issues independently or seek professional guidance.

- Email Support: Direct email support allows agents to submit detailed inquiries, receive personalized responses, and track the progress of their requests. This option provides an efficient avenue for specific and detailed questions.

- Phone Support: Dedicated phone support provides immediate assistance and allows for real-time problem-solving. This option is ideal for complex technical issues or time-sensitive situations.

Training Resources and Support Options Summary

| Category | Description |

|---|---|

| Training Resources | Online Tutorials, Webinars, Community Forums |

| Support Materials | Help Center, Knowledge Base, User Manuals |

| Support Channels | Customer Support Portal, Email Support, Phone Support |

Ending Remarks

In conclusion, Zoho CRM offers a comprehensive solution for insurance agents seeking to maximize their productivity and profitability. By leveraging its robust features, you can optimize client management, sales processes, and policy management, ultimately leading to a more efficient and rewarding work experience. Embrace the potential of Zoho CRM and unlock your agency’s full potential.

Frequently Asked Questions

What are the typical integrations for Zoho CRM used in insurance?

Zoho CRM integrates seamlessly with various tools, including policy management systems, billing platforms, and document management software, allowing for a unified workflow. Specific integrations vary depending on the particular needs of the insurance agency.

How can I customize Zoho CRM for my specific insurance workflows?

Zoho CRM offers a wide range of customization options, enabling you to tailor the platform to your specific workflow. From creating custom fields to modifying the user interface, you can personalize Zoho CRM to streamline your daily tasks and achieve maximum efficiency.

What security measures does Zoho CRM employ to protect sensitive insurance data?

Zoho CRM employs robust security measures, including data encryption, access controls, and regular security audits, to safeguard sensitive insurance data. Compliance features are also in place to meet industry regulations.

How does Zoho CRM help in policy renewals?

Zoho CRM allows for automated policy renewal reminders, ensuring timely reminders to clients and reducing the risk of missed renewals. It integrates with existing systems for seamless data flow and automated processes.