What is considered high blood pressure for life insurance? Navigating the world of life insurance can be tricky, especially when health factors come into play. Understanding the specific blood pressure thresholds used by insurers is crucial for securing the best possible coverage. This exploration delves into the intricacies of how life insurance companies assess blood pressure risks, comparing their standards to general health guidelines and examining the impact on premiums and coverage options.

Life insurance companies use a standardized approach to assess risk, and blood pressure is a significant factor. Factors like consistently elevated readings, pre-existing conditions, and management strategies all influence underwriting decisions. This detailed look at the relationship between blood pressure and life insurance decisions helps you understand how your health impacts your insurance options.

Defining High Blood Pressure for Life Insurance

Navigating the world of life insurance often involves understanding how various health factors influence premiums. A crucial aspect of this evaluation is blood pressure, as high blood pressure can impact an individual’s overall health and longevity. Understanding how life insurance companies assess blood pressure is vital for informed decision-making.High blood pressure, medically known as hypertension, is a condition where the force of blood against the artery walls is consistently elevated.

This persistent pressure can strain the cardiovascular system, increasing the risk of heart disease, stroke, and other serious health complications. Life insurance companies, therefore, consider high blood pressure a risk factor in their underwriting process.

Blood Pressure Readings for Life Insurance

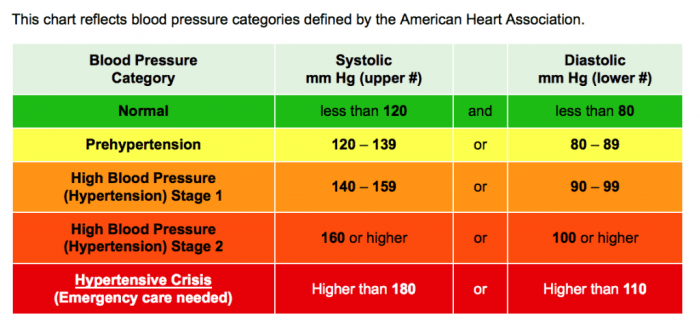

Life insurance companies use specific blood pressure readings to assess risk. A single elevated reading isn’t necessarily a cause for concern, but a pattern of consistently high readings warrants careful consideration. Systolic pressure, representing the pressure in the arteries when the heart beats, and diastolic pressure, representing the pressure when the heart rests between beats, are both scrutinized.

For example, readings consistently above 140/90 mmHg are often flagged as potentially problematic.

Factors Influencing Life Insurance Assessments

Several factors influence how life insurance companies assess blood pressure risks. These include the frequency of elevated readings, the individual’s overall health history, including other medical conditions, and any treatment plans in place. A history of hypertension, along with effective management strategies, might be viewed differently than uncontrolled hypertension with no management. Furthermore, the presence of other risk factors, such as smoking or a family history of cardiovascular disease, can further influence the assessment.

Comparison of Life Insurance Standards

Different life insurance companies may have slightly varying standards for classifying high blood pressure. Some companies may be more stringent in their criteria, while others might have more flexible standards. The variability in standards highlights the importance of consulting with a specific insurance provider to understand their precise requirements. Direct inquiries with the company will help clarify their assessment criteria for individuals with high blood pressure.

Impact on Life Insurance Premiums

Pre-existing high blood pressure can potentially impact life insurance premiums. Individuals with a history of high blood pressure may face higher premiums compared to those with normal blood pressure. The severity and control of the hypertension, as well as the individual’s overall health profile, play a crucial role in determining the premium adjustment. For instance, an individual successfully managing hypertension with medication and lifestyle changes might have a lower premium increase compared to someone with uncontrolled hypertension.

Life Insurance vs. General Health Guidelines

| Blood Pressure Category | Life Insurance (Example) | General Health Guidelines |

|---|---|---|

| Normal | Acceptable for most policies | Desirable for overall health |

| Elevated | May result in higher premiums, further assessment | Requires lifestyle changes and medical attention |

| High Blood Pressure (Stage 1) | Significant premium increase or policy denial | Requires treatment and regular monitoring |

| High Blood Pressure (Stage 2) | Higher premiums, potential policy denial | Requires aggressive treatment and lifestyle changes |

| Hypertensive Crisis | Likely policy denial or very high premiums | Immediate medical attention required |

This table provides a general comparison, but the specific premiums charged by different life insurance companies can vary significantly based on individual circumstances.

Impact of Blood Pressure on Life Insurance Decisions

High blood pressure, or hypertension, is a significant health concern that can influence life insurance decisions. Understanding how consistently elevated blood pressure affects underwriting is crucial for applicants seeking coverage. Life insurance companies carefully assess the risk associated with this condition to determine appropriate premiums and coverage levels.

Relationship Between Blood Pressure and Cardiovascular Risk

High blood pressure is a major risk factor for cardiovascular diseases, including heart disease and stroke. Sustained elevated blood pressure can damage blood vessels, increasing the likelihood of developing these serious conditions. The severity of the impact depends on factors like the level of blood pressure, the duration of the condition, and the presence of other risk factors.

Factors Considered by Life Insurance Companies

Life insurance companies meticulously evaluate applicants’ overall health risks. When assessing high blood pressure, they consider the severity and duration of the condition. They also take into account any co-existing conditions, such as diabetes or high cholesterol, which often compound the cardiovascular risks. The applicant’s response to treatment and adherence to prescribed medications are also important factors.

A whisper of a secret, a hidden number, defines high blood pressure for life insurance—a threshold often shrouded in mystery. Digging deeper, one might find solace in the comforting warmth of a well-crafted dish, perhaps recipes for honey gold potatoes , but the subtle pressure still lingers, a silent sentinel guarding the path to acceptance. The insurance company’s definition, a cryptic code, remains a mystery, a silent sentinel, awaiting the moment when a number rises above the acceptable mark.

It’s a strange dance, this waltz with numbers and potential outcomes.

Impact of Different Blood Pressure Readings

Different blood pressure readings translate into varying levels of risk. A consistently elevated but controlled blood pressure, managed with medication and lifestyle changes, usually carries a lower risk compared to uncontrolled or poorly managed hypertension. Insurance companies will carefully examine the applicant’s medical history, including details about blood pressure control, to assess the overall risk profile.

Conditions and Scenarios Triggering Additional Underwriting Questions

Certain conditions or scenarios may prompt further inquiries from the insurance company during the underwriting process. For instance, if an applicant has a history of severe or uncontrolled hypertension, the company might request detailed medical records, including blood pressure readings over a specific time period. If the applicant has had previous cardiovascular events (e.g., heart attack, stroke), this will be a significant factor in the assessment.

The presence of kidney disease, a common complication of uncontrolled high blood pressure, will also require further investigation. A history of poor adherence to medication or treatment plans could also raise concerns.

Criteria for Determining Insurability with High Blood Pressure

Insurability with high blood pressure hinges on a combination of factors, often presented in a multifaceted way. The primary criteria are listed below:

- Current Blood Pressure Control: The applicant’s current blood pressure readings and whether they are effectively managed with medication and lifestyle changes are crucial.

- Duration and Severity of Hypertension: The length of time the applicant has had high blood pressure and the severity of the condition are significant considerations. A longer duration or more severe condition may result in higher premiums or a denial of coverage.

- Presence of Co-morbidities: Co-existing conditions like diabetes, kidney disease, or high cholesterol significantly impact the overall risk assessment. These conditions often compound the cardiovascular risks associated with hypertension.

- Response to Treatment: The applicant’s response to prescribed medications and lifestyle modifications directly influences the assessment. Consistent adherence to treatment plans is essential for a favorable outcome.

- History of Cardiovascular Events: A history of heart attacks, strokes, or other cardiovascular events greatly increases the risk associated with hypertension, leading to a higher premium or even a denial of coverage.

Blood Pressure Management and Life Insurance

Maintaining healthy blood pressure is crucial for overall well-being and plays a significant role in life insurance considerations. A consistent, controlled blood pressure profile demonstrates a lower risk of cardiovascular complications, a key factor insurers evaluate when assessing your health profile. This section delves into how blood pressure management strategies impact insurability, emphasizing the importance of consistent control and the impact of lifestyle changes and medications.Effective blood pressure management significantly impacts life insurance decisions.

Insurers meticulously assess the risk of future health problems, and controlled blood pressure is a strong indicator of a lower risk profile. Consistent, well-managed blood pressure reflects a commitment to health and a lower likelihood of developing cardiovascular issues, leading to favorable life insurance terms.

Lifestyle Changes and Insurability

Consistent lifestyle changes contribute significantly to effective blood pressure management and positively affect life insurance prospects. Dietary modifications and regular exercise are crucial components of a comprehensive blood pressure management plan.

- Dietary Modifications: A balanced diet rich in fruits, vegetables, and whole grains, while limiting saturated and trans fats, sodium, and added sugars, is fundamental to blood pressure control. This contributes to a lower risk of developing hypertension and related complications, ultimately improving insurability.

- Regular Exercise: Physical activity strengthens the cardiovascular system, helping regulate blood pressure and reduce the risk of developing cardiovascular disease. Consistent exercise routines, tailored to individual needs and capabilities, positively influence insurability.

Medications and Insurability, What is considered high blood pressure for life insurance

Medications play a crucial role in managing blood pressure, particularly when lifestyle changes alone are insufficient. The impact of blood pressure medications on life insurance is multifaceted.

- Blood Pressure Medications: Several classes of medications are used to manage high blood pressure. The selection and dosage of medication are tailored to individual needs and medical conditions. Insurers may require detailed information regarding the medications taken, their dosages, and their duration. This information helps them assess the current health status and potential future risks.

Comprehensive Blood Pressure Management Plan

A comprehensive blood pressure management plan is a critical element in life insurance applications. It demonstrates a proactive approach to health and reduces the risk of future complications.

- Regular Check-ups: Consistent medical check-ups are essential to monitor blood pressure and ensure appropriate management. This proactive approach demonstrates a commitment to maintaining health, improving insurability, and potentially influencing premiums.

- Documentation: Detailed records of blood pressure readings, medical consultations, and any prescribed medications are crucial. Clear documentation aids in assessing the consistency and effectiveness of blood pressure management, ultimately influencing insurance considerations.

Lifestyle Changes and Medications Affecting Insurability

Certain lifestyle choices and medications can influence life insurance considerations.

- Smoking: Smoking significantly increases the risk of cardiovascular disease and negatively impacts insurability. Stopping smoking is a crucial step in improving overall health and positively influencing insurance prospects.

- Alcohol Consumption: Excessive alcohol consumption can negatively affect blood pressure and overall health, impacting insurability. Moderation in alcohol consumption is crucial for maintaining good health and influencing favorable insurance outcomes.

- Medications: Insurers review all medications to assess potential health risks and their impact on insurability. Information regarding specific medications, dosages, and treatment durations are vital factors for the insurer to consider.

Blood Pressure and Insurance Coverage Options

Navigating the world of life insurance with high blood pressure can feel daunting, but understanding how insurers approach this condition is key. Knowing your options empowers you to make informed decisions about coverage and premiums. It’s important to remember that insurance companies assess risk factors, and blood pressure is a significant one.Insurers carefully evaluate an individual’s health status to determine the appropriate level of risk and coverage.

This process considers not just the current blood pressure readings, but also the individual’s overall health history, including lifestyle choices, family history, and management strategies.

Different Life Insurance Policy Approaches to High Blood Pressure

Life insurance policies often employ different strategies to address high blood pressure. Some policies may assess the risk associated with high blood pressure and adjust premiums accordingly, while others may offer reduced coverage amounts or exclude certain risks altogether. Understanding these approaches is crucial for comparing policies and selecting the best fit for your needs.

Modifications to Coverage for Individuals with High Blood Pressure

Modifications to coverage vary significantly based on the insurance company and the specific policy. Some policies may offer reduced coverage amounts for individuals with high blood pressure, while others may exclude coverage for certain pre-existing conditions. The level of coverage reduction or exclusion depends on the severity and management of the high blood pressure.

Options for Individuals with High Blood Pressure to Obtain Life Insurance

Individuals with high blood pressure have options for obtaining life insurance. A healthy lifestyle, consistent medication adherence, and demonstrable blood pressure control can significantly influence an insurance company’s assessment of risk. Open communication with insurance agents and providing comprehensive medical records are crucial steps in securing the desired coverage. Some insurers may offer policies tailored for individuals with pre-existing conditions, although these may come with higher premiums.

Variations in Premium Rates Based on Blood Pressure Levels and Management

Premium rates for life insurance policies are often influenced by blood pressure levels and management strategies. Individuals who maintain healthy blood pressure levels through lifestyle modifications and medication adherence often receive more favorable premium rates. This demonstrates that proactive management of high blood pressure can positively impact the cost of insurance. In contrast, uncontrolled high blood pressure can result in significantly higher premiums.

Comparison of Life Insurance Options for Individuals with High Blood Pressure

| Insurance Company | Policy Type | Coverage Amount | Premium Rate | Conditions/Exclusions |

|---|---|---|---|---|

| Company A | Standard Term Life | $500,000 | $150/year | May adjust premiums based on blood pressure readings and management |

| Company B | Simplified Issue | $250,000 | $200/year | Higher premiums due to higher risk assessment |

| Company C | Guaranteed Issue | $100,000 | $300/year | Higher premiums due to higher risk assessment |

This table provides a simplified comparison of different life insurance options. Actual coverage amounts, premium rates, and conditions may vary significantly depending on individual circumstances and insurance company policies.

A whisper in the wind, a subtle pressure, a hint of something… high. That’s what a life insurance company might consider when evaluating your blood pressure. Preparing a standing rib roast on a rotisserie, a delectable culinary adventure , requires a delicate touch, much like the subtle shift in the numbers that can make or break your insurance application.

A little too high, and the whispers turn to a chilling gust. The mysterious realm of blood pressure thresholds for life insurance lurks, a subtle yet significant factor.

Common Life Insurance Products and Their Features for Individuals with High Blood Pressure

- Term Life Insurance: This type of policy provides coverage for a specific period, often 10, 20, or 30 years. Premiums are generally lower than permanent life insurance, but coverage ends at the policy’s expiration date. Insurers will likely assess the risk and adjust premiums based on the blood pressure level and management.

- Permanent Life Insurance: This type of policy provides lifelong coverage. Premiums are typically higher than term life insurance, but the coverage remains in effect throughout the policyholder’s lifetime. Policies may include cash value components, which grow over time.

- Simplified Issue Life Insurance: Designed for individuals with some health conditions, simplified issue policies may have more relaxed underwriting standards compared to standard policies. However, premiums are often higher due to the increased risk assessment.

- Guaranteed Issue Life Insurance: This type of policy offers coverage to individuals with significant health concerns, including high blood pressure. Premiums are typically higher, but the policy is often a crucial option for those who face challenges in obtaining standard coverage.

This list highlights common life insurance products. The specific features and eligibility criteria may vary depending on the individual and the insurance provider.

Concluding Remarks: What Is Considered High Blood Pressure For Life Insurance

In conclusion, understanding what constitutes high blood pressure for life insurance is essential for securing appropriate coverage. Life insurance companies consider a variety of factors, including consistent readings, pre-existing conditions, and management strategies. By understanding these nuances, individuals can proactively manage their health and make informed decisions about their life insurance needs. The key takeaway is to be proactive about your health and work with your insurer to find the best coverage that aligns with your situation.

Helpful Answers

What blood pressure readings are considered high-risk for life insurance?

Specific readings vary by insurer, but generally, consistently elevated systolic (the top number) and/or diastolic (the bottom number) pressures above certain thresholds trigger closer scrutiny. Consult with a life insurance agent or your doctor for personalized guidance.

How does pre-existing high blood pressure affect life insurance premiums?

Pre-existing high blood pressure can lead to higher premiums or potentially limit coverage options. The extent of the impact depends on the severity and management of the condition, as well as the specific insurer’s underwriting guidelines.

Can lifestyle changes improve my insurability with high blood pressure?

Yes, demonstrable lifestyle changes, such as a healthy diet, regular exercise, and stress management, can positively influence underwriting decisions. Consistent blood pressure control through lifestyle adjustments can help improve insurability and potentially reduce premiums.

What types of medical records are reviewed by life insurance companies?

Insurance companies review medical records, including blood pressure readings, medical history, and treatment plans to assess the overall health risk. They may also request recent blood pressure monitoring reports, and details of any treatments or medications.