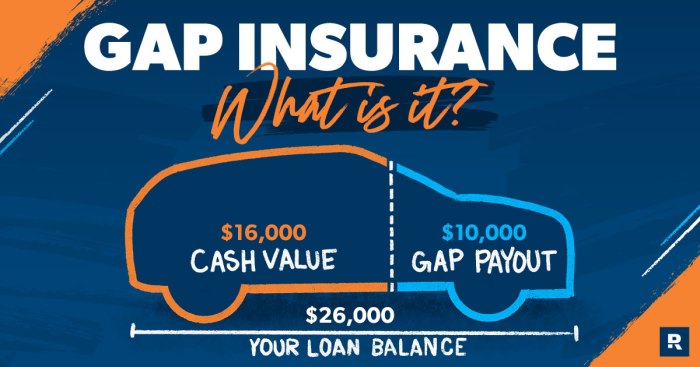

How much does gap insurance usually cost? This question is crucial for prospective vehicle purchasers and existing owners. Gap insurance, designed to bridge the difference between a vehicle’s market value and outstanding loan amount in case of a total loss, can vary significantly based on several factors. Understanding these factors is essential to accurately assess the likely cost.

This analysis explores the multifaceted determinants of gap insurance premiums, ranging from vehicle type and age to loan amounts and negotiating strategies. Comprehensive insights into premium ranges, provider comparisons, and cost-reduction methods are presented. Furthermore, the document provides practical guidance on estimating costs before purchase and offers illustrative examples for enhanced clarity.

Factors Influencing Gap Insurance Costs

Gap insurance premiums are not a fixed amount; they vary significantly depending on several key factors. Understanding these factors is crucial for accurately assessing the potential cost of this coverage. This analysis explores the key elements influencing the price of gap insurance.

Vehicle Type

Various vehicle characteristics impact the likelihood of a vehicle’s value depreciating faster than its loan amount. Luxury vehicles, for example, often experience a steeper initial depreciation rate compared to compact cars. This is often due to factors like perceived prestige, limited production runs, or higher manufacturing costs. Similarly, trucks, especially those with specialized features, can see a quicker decline in resale value than a standard compact car.

| Vehicle Type | Typical Impact on Premium | Example | Explanation |

|---|---|---|---|

| Luxury Car | Higher Premium | A 2023 Lamborghini Aventador | High initial depreciation rate and potentially lower resale value. |

| Compact Car | Lower Premium | A 2023 Honda Civic | Moderate depreciation rate and generally higher resale value compared to luxury cars. |

| Truck | Variable Premium | A 2023 Ram 1500 | Depreciation rate depends on the truck’s features and model. Specialized features like off-road capabilities might lead to a higher premium. |

Vehicle Age

The age of the vehicle is a significant factor influencing gap insurance costs. Older vehicles depreciate more rapidly than newer ones. This is because newer vehicles often retain a higher percentage of their original value over time. A 2023 model car will typically have a lower gap insurance premium than a 2018 model car of the same make and model, given comparable loan amounts.

Loan Amount

The loan amount directly correlates with the gap insurance cost. A larger loan amount means a greater potential gap between the vehicle’s value and the outstanding loan balance. This results in a higher gap insurance premium to cover the difference.

A $30,000 loan on a vehicle will typically have a higher gap insurance premium than a $15,000 loan on the same vehicle.

For example, a $25,000 loan on a 2023 SUV will likely require a higher premium than a $15,000 loan on the same vehicle, reflecting the larger potential gap in value.

Down Payment

A higher down payment reduces the loan amount, which in turn lowers the gap insurance premium. A larger down payment indicates a greater portion of the vehicle’s cost is covered upfront, thus decreasing the loan amount and the associated potential gap.

Loan Terms

Loan terms, specifically the length of the loan, can affect the gap insurance cost. Longer loan terms typically result in higher premiums, as the potential gap between the vehicle’s value and the loan balance increases over the longer duration of the loan. A 60-month loan might have a higher premium than a 36-month loan for the same vehicle and loan amount.

Credit Score

A borrower’s credit score, although less directly correlated with the gap insurance itself, can indirectly influence the premium through its impact on the loan terms and interest rate. Lower credit scores often translate to higher interest rates, potentially increasing the total cost of the loan and the gap insurance premium as a result.

Typical Gap Insurance Premium Ranges

Gap insurance premiums are contingent on several factors, including the vehicle’s make, model, and age, the loan amount, and the lender’s requirements. Understanding these ranges allows potential buyers to anticipate the financial commitment associated with this type of coverage.Determining the appropriate gap insurance premium requires careful consideration of the vehicle’s value, the loan amount, and the potential for depreciation.

Factors like the vehicle’s condition and market trends further influence the calculated premium.

Premium Ranges for Different Vehicle Types

Premiums for gap insurance vary significantly depending on the type of vehicle. The price of a luxury vehicle often necessitates a higher premium compared to a compact car due to its higher potential for depreciation. This difference in potential loss is reflected in the gap insurance cost.

- Compact Cars (under $20,000): Premiums typically range from 0.5% to 2% of the loan amount. For example, a loan of $15,000 for a 2-year-old compact car might cost between $75 and $300 annually.

- Mid-size Sedans (under $30,000): Gap insurance premiums for mid-size sedans usually fall between 0.75% and 2.5% of the loan amount. A loan of $25,000 for a 3-year-old mid-size sedan could incur premiums from $187.50 to $625 annually.

- Luxury Vehicles (over $50,000): These vehicles frequently experience higher depreciation rates, resulting in premiums that can exceed 2.5% of the loan amount. For example, a loan of $60,000 for a 2-year-old luxury vehicle could cost between $1,500 and $1,800 per year.

- SUVs and Trucks: Premiums for SUVs and trucks often align with mid-size sedan ranges but can fluctuate depending on the specific model and its depreciation rate. Similar to the examples above, a loan of $30,000 for a 2-year-old SUV could result in a gap insurance premium between $225 and $750 annually.

Impact of Vehicle Age and Loan Amount on Premiums

The age of the vehicle and the loan amount directly influence the gap insurance premium. Older vehicles typically have a greater potential for depreciation, leading to higher premiums. Similarly, larger loan amounts result in higher premiums due to the increased financial exposure.

- Older Vehicles (5+ years): Premiums for older vehicles are often higher than for newer models due to accelerated depreciation. This can be particularly noticeable in high-demand vehicles.

- Higher Loan Amounts: As the loan amount increases, the potential gap between the vehicle’s value and the loan amount grows, resulting in a higher premium.

Gap Insurance Premium Variations Across Providers

Insurance providers offer varying rates for gap insurance. This difference is attributed to factors such as their operational costs, profit margins, and the specific market conditions in which they operate.

| Insurance Provider | Estimated Premium for a $25,000 Loan on a 2-year-old Mid-size Sedan | Estimated Premium for a $40,000 Loan on a 3-year-old SUV | Estimated Premium for a $15,000 Loan on a 1-year-old Compact Car |

|---|---|---|---|

| Company A | $250 | $600 | $100 |

| Company B | $300 | $750 | $125 |

| Company C | $200 | $550 | $90 |

Comparison of Gap Insurance Costs Based on Loan-to-Value Ratio

The loan-to-value (LTV) ratio significantly impacts gap insurance premiums. A higher LTV ratio indicates a larger loan amount relative to the vehicle’s value, increasing the risk of a gap and the premium.

| Loan-to-Value Ratio | Estimated Premium for a $25,000 Loan on a 3-year-old Mid-size Sedan (estimated market value $35,000) | Estimated Premium for a $40,000 Loan on a 4-year-old SUV (estimated market value $50,000) | Estimated Premium for a $15,000 Loan on a 2-year-old Compact Car (estimated market value $20,000) |

|---|---|---|---|

| 80% | $200 | $500 | $75 |

| 90% | $250 | $650 | $100 |

| 95% | $300 | $800 | $125 |

Gap Insurance Cost Comparison Across Different Providers

A crucial aspect of understanding gap insurance is comparing costs across various providers. This comparison allows consumers to make informed decisions, ensuring they secure the most suitable coverage at the most competitive price. Different pricing strategies and policy terms significantly influence the final cost.

Factors Influencing Provider Pricing Strategies

Several factors contribute to the variation in gap insurance pricing strategies among providers. These factors include the provider’s overall business model, the specific coverage details within the policy, and the financial health of the insured. Understanding these factors is vital for a comprehensive cost comparison.

Pricing Models Employed by Different Providers

Various pricing models are employed by insurance providers to determine gap insurance premiums. Some providers utilize a fixed premium structure, while others employ a variable pricing model based on factors such as vehicle type, model year, and purchase price. This variability necessitates a careful examination of the different models to understand their implications for cost.

Comparison of Gap Insurance Costs Across Providers

The following table presents a comparative analysis of gap insurance costs from different providers. It highlights the differences in pricing structures and the impact of policy terms and conditions. The data reflects hypothetical scenarios and should not be considered definitive.

| Provider | Pricing Model | Example Policy (Vehicle: 2023 Sedan, Purchase Price: $30,000) | Policy Terms and Conditions Impact |

|---|---|---|---|

| Provider A | Fixed Premium | $150 per year | Coverage limited to 12 months, no add-on options for extended coverage |

| Provider B | Variable Premium (based on vehicle depreciation) | $200 per year | Coverage extends up to 36 months, allows for adding optional extended warranty coverage |

| Provider C | Tiered Premium (based on vehicle type and purchase price) | $180 per year | Higher coverage limit for luxury vehicles, lower coverage limit for standard vehicles |

| Provider D | Premium dependent on deductibles | $120 per year | Lower deductible means higher premium, higher deductible means lower premium |

Impact of Policy Terms and Conditions on Gap Insurance Costs

Policy terms and conditions play a significant role in determining the final cost of gap insurance. Specific examples illustrate this effect. A policy with a higher coverage limit or extended coverage period typically results in a higher premium. Similarly, policies with additional add-on options, such as enhanced coverage for specific parts or comprehensive coverage for specific incidents, will increase the cost.

Gap insurance premiums, a crucial aspect of car ownership, typically fluctuate based on factors like the vehicle’s make and model. Understanding the precise cost often hinges on consulting an insurance provider directly. However, for those exploring weight loss solutions, a critical aspect of considering tirzepatide dosage is to understand how many units of tirzepatide for weight loss.

Ultimately, determining the right gap insurance coverage amount remains a personalized decision, influenced by individual needs and financial situations.

Conversely, policies with limited coverage or shorter coverage periods tend to have lower premiums. The following are further examples of how policy terms impact pricing:

- Coverage Period: Policies with longer coverage durations generally have higher premiums due to the increased risk over a longer period.

- Deductibles: Policies with lower deductibles offer broader coverage but result in higher premiums.

- Exclusions: Policies with extensive exclusions for specific circumstances will usually have lower premiums.

Negotiating Gap Insurance Costs

Negotiating the cost of gap insurance can be a valuable strategy for consumers seeking to minimize expenses. While not always guaranteed, proactive communication and understanding of the factors influencing pricing can lead to potential savings. This section details strategies and considerations for effective negotiation.

Strategies for Negotiating Gap Insurance Premiums

Effective negotiation requires a strategic approach. Gathering information about the policy’s terms, comparing premiums across providers, and understanding the specific coverage options are crucial first steps. Presenting a clear understanding of the desired coverage and the customer’s financial situation can also improve the likelihood of success. Documentation of comparable policies and pricing from other providers is vital in supporting a negotiation request.

Gap insurance premiums typically vary widely, depending on the vehicle’s make and model, its value, and the loan amount. Factors like your credit history and driving record also play a role. To get a precise quote, you should consult with a financial institution like enterprise bank and trust overland park , who can provide tailored estimations based on your specific needs.

Ultimately, the cost will depend on these personalized details.

Furthermore, highlighting any unique circumstances, such as a favorable credit rating or a history of prompt payments, might strengthen the negotiation position.

Factors Influencing a Provider’s Willingness to Negotiate

Several factors influence an insurance provider’s willingness to negotiate gap insurance premiums. A provider’s current market share, competition from other insurers, and the overall demand for gap insurance policies are significant factors. The financial strength of the customer, including creditworthiness and payment history, also plays a crucial role in determining the insurer’s willingness to negotiate. Moreover, the specific terms of the proposed coverage, including the vehicle’s make, model, and year, and the desired coverage limits, can influence the insurer’s perspective on negotiating.

The insurer’s internal pricing models and profit margins also play a part in determining whether a negotiation is feasible.

Methods for Identifying Potential Savings on Gap Insurance

Identifying potential savings requires a thorough comparison of different policies and providers. Online comparison tools and independent financial advisors can provide valuable insights into various gap insurance options. Carefully reviewing policy documents and understanding the specific exclusions and limitations can help avoid hidden costs. Analyzing comparable quotes from multiple providers is crucial in identifying potential savings. This comparison should include not only the base premium but also any additional fees or charges associated with the policy.

Furthermore, considering the specific features of each policy and their potential value is essential in making an informed decision.

Examples of Successful Gap Insurance Cost Negotiation

Successful negotiation examples demonstrate the potential for cost savings. One instance involved a customer with a strong credit history and a consistent payment record. By presenting a detailed comparison of gap insurance quotes from multiple providers, along with the customer’s favorable financial standing, the customer was able to negotiate a significant reduction in the premium. Another example involved a customer who highlighted a specific policy feature that the insurer had recently adjusted, creating a leverage point for negotiation.

These examples show the importance of preparation, understanding the factors influencing a provider’s willingness to negotiate, and presenting a clear case for reduced costs.

Understanding the Impact of Discounts and Promotions

Gap insurance premiums, while varying significantly, can be influenced by numerous factors. One critical aspect affecting the final cost is the availability and application of discounts and promotions offered by insurance providers. Understanding these can lead to substantial savings.

Types of Discounts and Promotions, How much does gap insurance usually cost

Various discounts and promotions are designed to incentivize customers and encourage the purchase of gap insurance. These often fall into specific categories, such as loyalty programs, bundled insurance packages, and early payment incentives. Each category has a specific impact on the premium calculation.

Loyalty Programs

Existing customers often benefit from loyalty programs. These programs may offer a percentage reduction in the gap insurance premium for customers who have maintained their insurance coverage with the same provider for a certain period. For example, a customer who has held gap insurance with a particular provider for five years might qualify for a 5% discount on their premium.

The discount is typically applied directly to the calculated premium.

Bundled Insurance

Bundling gap insurance with other insurance products, such as auto, home, or life insurance, with the same provider can frequently lead to discounted rates. This is a common practice among insurance providers, and it allows for a holistic approach to risk management. The discount is often calculated as a percentage reduction from the standard premium for gap insurance alone. A customer who bundles their gap insurance with their auto insurance, for instance, might receive a 10% discount.

Early Payment Discounts

Some insurance providers offer discounts for early payment of premiums. This incentive encourages prompt payment and often leads to a small reduction in the overall cost of gap insurance. The exact amount of the discount can vary based on the provider and the timing of payment. For instance, a provider may offer a 2% discount for payment made within the first 10 days of the policy’s billing cycle.

Impact of Bundled Insurance on Gap Insurance Costs

| Insurance Type | Gap Insurance Premium (Standalone) | Bundled Gap Insurance Premium | Discount Amount |

|---|---|---|---|

| Auto Insurance | $150 | $135 | $15 |

| Homeowners Insurance | $100 | $90 | $10 |

| Life Insurance | $75 | $67.50 | $7.50 |

The table above illustrates how bundling gap insurance with other insurance products can lead to reduced costs. In each scenario, the bundled premium is lower than the standalone premium, reflecting the discount offered. This demonstrates a significant cost-saving opportunity for consumers.

Estimating Gap Insurance Costs Before Purchase

Accurate estimation of gap insurance costs is crucial for informed financial planning. This process allows potential buyers to factor the cost into their overall vehicle budget and avoid unexpected expenses. Understanding the factors influencing premiums, and utilizing available tools, enables a proactive approach to managing potential financial obligations.

Factors for Estimating Gap Insurance Costs

Several key factors influence the premium for gap insurance. These elements, when considered collectively, provide a more precise estimate.

- Vehicle’s Value: The market value of the vehicle significantly impacts the gap insurance cost. A higher vehicle value typically results in a higher premium, as the potential gap between the vehicle’s value and outstanding loan amount increases.

- Loan Amount: The outstanding loan amount on the vehicle directly correlates with the potential gap. A larger loan amount means a greater potential for the gap to exceed the value of the vehicle, thereby increasing the insurance premium.

- Loan Terms: The loan term and interest rate play a part in the overall cost of financing. Longer terms and higher interest rates result in higher loan amounts, leading to increased gap insurance premiums.

- Down Payment: A larger down payment reduces the loan amount and, consequently, the potential gap, potentially lowering the gap insurance premium.

- Insurance Provider: Different insurance providers may offer varying rates for gap insurance. Comparison shopping is essential to find the most favorable pricing.

Utilizing Online Calculators for Prediction

Online gap insurance calculators provide a convenient and quick way to estimate the potential cost. These tools often require inputting crucial vehicle and loan details, allowing users to see an immediate estimate.

- Inputting Details: Accurately inputting the vehicle’s value, loan amount, and loan terms into the calculator is critical for generating an accurate estimate. Errors in these details will lead to inaccurate estimations.

- Comparing Results: Users should compare results from multiple online calculators to ensure a comprehensive understanding of potential costs. This helps in identifying any significant differences in estimates and allows for informed decision-making.

- Verification: It is crucial to verify the accuracy of the results obtained from online calculators with the actual figures from potential insurance providers. This step ensures the calculated cost aligns with the insurer’s quoted rate.

Step-by-Step Procedure for Estimating Gap Insurance Costs

This step-by-step procedure provides a structured approach to estimate gap insurance costs:

- Gather Information: Collect details about the vehicle’s market value, the outstanding loan amount, loan terms, and down payment. Ensure all figures are accurate.

- Use Online Calculators: Employ online gap insurance calculators to input the gathered data and obtain initial cost estimates. This provides a starting point for comparison.

- Compare Quotes: Obtain quotes from various insurance providers. Comparing multiple quotes allows for identification of the most favorable premium.

- Evaluate Discounts: Investigate any available discounts from the insurance providers to potentially lower the premium.

- Factor in Additional Costs: Consider any additional fees or charges associated with the gap insurance. This should be factored into the final decision-making process.

Illustrative Examples of Gap Insurance Premiums

Gap insurance premiums are contingent upon various factors, making a precise universal figure impractical. Understanding the interplay of these factors, however, allows for a more informed assessment of potential costs. This section provides illustrative examples to better contextualize gap insurance premium structures.

Luxury Vehicle with High Loan Amount

Premiums for gap insurance on a new luxury vehicle with a substantial loan amount will generally be higher than those for a used, more modestly priced vehicle. This is due to the higher outstanding loan balance and the potential for the vehicle’s depreciated value to exceed the loan amount.

- Scenario: A new luxury sports car with a $75,000 loan, and an estimated depreciation of 25% within the first year. The car’s purchase price is $100,000.

- Factors: The significant loan amount, the expected rapid depreciation of the luxury vehicle’s value, and the high initial purchase price all contribute to the higher premium. The insurer will assess the loan amount, the estimated residual value of the vehicle, and the terms of the loan agreement to determine the gap.

- Estimated Premium: $150-$300 per year. This is a rough estimate. Actual premiums may vary based on the specific insurer, the vehicle’s make and model, the loan terms, and the policy conditions.

- Premium Calculation: The premium is calculated based on the difference between the outstanding loan amount and the estimated value of the vehicle after depreciation. The insurance company factors in the loan term, the vehicle’s value depreciation rate, and the risk factors associated with the vehicle type.

Used Compact Car with Low Loan Amount

Conversely, a used compact car with a lower loan amount will likely have a significantly lower gap insurance premium. This is because the loan amount is smaller, and the depreciation of the vehicle is expected to be more modest compared to a luxury vehicle.

- Scenario: A used compact car with a $10,000 loan, and an estimated depreciation of 10% within the first year. The car’s purchase price is $20,000.

- Factors: The lower loan amount, the relatively lower expected depreciation, and the vehicle’s lower initial price directly influence the lower premium. Insurers will factor in the age, condition, and mileage of the vehicle in assessing the premium.

- Estimated Premium: $50-$100 per year. This is an approximate estimate and may differ based on the specific insurer, vehicle details, and the terms of the loan.

- Premium Calculation: The calculation is similar to the luxury vehicle scenario, but the difference between the loan amount and the expected residual value will be much smaller, resulting in a lower premium.

Comparison to Average Costs

The examples above highlight the wide range of gap insurance premiums. Premiums for used vehicles with smaller loans fall within the typical range of gap insurance costs, while those for new luxury vehicles with high loans are higher than the average. A comparison across various insurers, loan terms, and vehicle types is essential to arrive at the most cost-effective solution.

Ultimate Conclusion: How Much Does Gap Insurance Usually Cost

In conclusion, the cost of gap insurance is a dynamic figure shaped by a complex interplay of variables. Vehicle characteristics, loan terms, and insurance provider policies all contribute to the final premium. This analysis has provided a comprehensive overview, enabling informed decisions regarding gap insurance. By understanding the factors influencing cost, prospective buyers can make well-reasoned choices and potentially negotiate favorable premiums.

Ultimately, the decision to purchase gap insurance is a personal one, weighing the potential financial risk against the cost of coverage.

Key Questions Answered

What is the typical range of gap insurance premiums for a new luxury car with a high loan amount?

Premiums for a new luxury car with a high loan amount typically fall within a range of 1-3% of the loan amount annually. However, exact figures depend on the specific vehicle model, loan terms, and the chosen insurance provider.

How does a down payment affect the gap insurance cost?

A larger down payment typically reduces the loan amount, which, in turn, reduces the gap insurance premium. A higher proportion of the vehicle’s value financed will correlate with a higher gap insurance cost.

Can I negotiate the cost of gap insurance?

Yes, negotiating is possible. Factors such as your credit history, bundled insurance policies, and your willingness to shop around can influence a provider’s willingness to negotiate. Successful negotiation often requires proactive communication and a clear understanding of market rates.

Are there any discounts available for gap insurance?

Yes, various discounts, including loyalty programs and bundled insurance packages, can significantly reduce gap insurance costs. Early payment discounts are another possibility.