Does new teeth now take insurance? Navigating dental insurance coverage for significant procedures like implants, bridges, or dentures can feel like navigating a complex maze. Understanding the intricacies of your policy, the specific procedures, and the potential out-of-pocket costs is key to making informed decisions. This guide will illuminate the path to clarity, empowering you to understand your options and make the best choices for your oral health.

This comprehensive resource explores the nuances of dental insurance coverage for new teeth procedures. We’ll delve into various insurance types, common procedures, coverage details, and the critical factors that influence insurance decisions. Ultimately, this guide equips you with the knowledge to confidently address your dental needs and explore the financial aspects of new teeth treatments.

Understanding Insurance Coverage for Dental Procedures

Dental insurance plays a crucial role in affording necessary dental care. Understanding the intricacies of different insurance plans is essential for maximizing benefits and minimizing out-of-pocket expenses. This section delves into the specifics of insurance coverage models, common procedures covered, and factors influencing coverage decisions.Dental insurance coverage is not a one-size-fits-all approach. Different plans offer varying degrees of coverage, impacting the cost of procedures and the patient’s financial responsibility.

While some dental procedures may be covered by insurance, the specifics of whether new teeth now take insurance depend on your individual plan. If you’re looking to catch the Legally Blonde tour 2024 tickets, be sure to check legally blonde tour 2024 tickets for availability and pricing. Ultimately, consulting with your insurance provider is key to understanding if your policy covers new dental work.

Navigating these differences empowers individuals to make informed decisions about their dental care.

Dental Insurance Coverage Models

Various models of dental insurance exist, each with unique characteristics regarding coverage, benefits, and limitations. Understanding these models is paramount for making informed choices about dental care. Key examples include Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs).

- Preferred Provider Organizations (PPOs): PPOs allow patients greater flexibility in choosing dentists. Patients typically pay lower out-of-pocket costs when utilizing a network dentist. However, costs can increase significantly for non-network dentists. The extent of coverage is usually broader compared to HMOs, but it is also more dependent on the specific plan and negotiated rates with the providers.

- Health Maintenance Organizations (HMOs): HMOs typically restrict patient choices to dentists within their network. The advantage lies in predictable and often lower out-of-pocket costs. However, a patient must obtain a referral to visit a specialist. This structured approach can streamline the cost of dental care, but the restrictions on dentist selection can be limiting.

Common Dental Procedures Covered

Many dental insurance plans cover routine preventative care, restorative treatments, and some specialized procedures. The specific procedures covered vary significantly between insurance providers.

- Preventative care: Routine checkups and cleanings are frequently covered at a substantial rate. The coverage percentage may differ across plans. Early detection and preventative care can significantly reduce long-term dental issues and costs.

- Restorative treatments: Fillings, crowns, and bridges may be covered, though the degree of coverage can differ greatly. Coverage percentages and the amount of co-pays vary significantly depending on the specific plan.

- Specialized procedures: Some plans may cover procedures like root canals, extractions, and dentures. The extent of coverage often depends on the plan’s benefit schedule and the specific procedure.

Factors Determining Coverage

Several factors influence whether a dental procedure is covered by insurance. Understanding these factors is vital for anticipating potential out-of-pocket expenses.

- Plan type: The type of plan, whether PPO or HMO, directly impacts coverage. Different plans have varying levels of coverage for specific procedures.

- Procedure type: Some procedures, such as cosmetic work, may not be covered by insurance. The type of procedure, its necessity, and its relation to preventative or restorative care can all influence coverage decisions.

- Provider network: Using a dentist within the insurance network significantly impacts coverage. Patients using in-network providers often experience more favorable coverage percentages and lower costs.

Comparison of Insurance Types

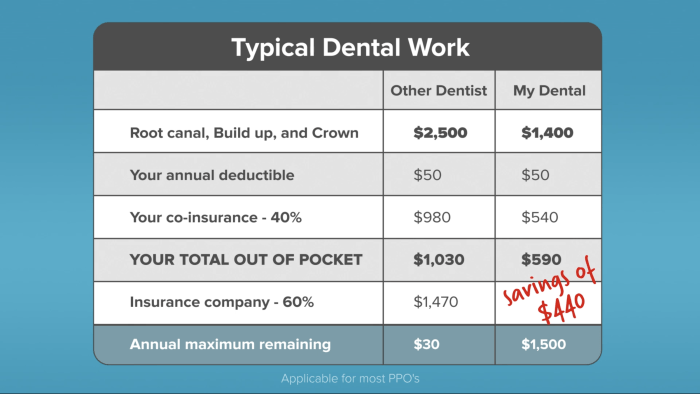

This table illustrates the key differences between PPO and HMO dental insurance plans, highlighting coverage details, deductibles, and co-pays. Understanding these variations is critical for informed financial planning regarding dental care.

| Insurance Type | Coverage Details | Deductibles | Co-pays |

|---|---|---|---|

| PPO | Generally broader coverage, but depends on the plan and provider network. Greater flexibility in choosing dentists. | Typically a higher deductible amount compared to HMOs. | Co-pays may be higher for non-network providers. |

| HMO | Generally more limited coverage compared to PPOs, but often lower out-of-pocket costs. Requires referrals for specialist care. | Generally lower deductible amounts compared to PPOs. | Co-pays are typically lower. |

New Teeth Procedures and Insurance

Navigating the complexities of dental insurance can be daunting, especially when considering major procedures like implants or dentures. Understanding the potential costs and coverage for these procedures is crucial for effective financial planning. This section delves into common new teeth procedures and their typical insurance coverage.Modern dentistry offers a range of options for restoring or replacing teeth, each with its own financial implications.

Insurance policies often play a significant role in determining the out-of-pocket expenses associated with these procedures. This discussion will Artikel the typical coverage for various procedures, helping individuals make informed decisions about their dental health.

Common New Teeth Procedures

A variety of procedures can restore or replace missing teeth, each with its own set of benefits and drawbacks. This discussion will focus on implants, bridges, and dentures, highlighting their characteristics and potential financial considerations.

- Dental Implants: Dental implants are artificial tooth roots surgically placed into the jawbone. They provide a strong foundation for replacement teeth, offering a natural-looking and durable solution. Implants typically involve multiple appointments, including surgical placement and subsequent restoration with a crown or other prosthetic.

- Dental Bridges: Dental bridges are used to replace one or more missing teeth. They are fixed restorations that span the gap created by missing teeth. A bridge consists of artificial teeth supported by crowns on adjacent teeth, often using a variety of materials. The durability and aesthetics of bridges depend on the materials used and the skill of the dentist.

- Dentures: Dentures are removable appliances used to replace all or some missing teeth. Full dentures replace all teeth, while partial dentures replace some. Dentures can be made of various materials, including acrylic and metal alloys, and are custom-made to fit each patient’s mouth. They offer a cost-effective solution for replacing missing teeth.

Cost of Procedures and Potential Out-of-Pocket Expenses

The cost of new teeth procedures varies significantly based on the complexity of the procedure, the materials used, and the geographic location. These costs often include not only the procedure itself but also any necessary pre- and post-operative care. Patients should always inquire about all potential costs upfront to avoid surprises.

- Dental Implants: Implant costs can range from several hundred to several thousand dollars per implant, depending on the complexity of the procedure and the materials used. Additional costs may include the cost of the crown or other prosthetic that is attached to the implant. Pre- and post-operative appointments and follow-up care are additional expenses.

- Dental Bridges: The cost of a dental bridge can range from several hundred to several thousand dollars. The cost depends on the number of teeth replaced and the materials used for the bridge. Additional costs include the preparation of the supporting teeth and follow-up care.

- Dentures: The cost of dentures can vary from a few hundred to a few thousand dollars. The type of denture (complete or partial), the materials used, and the complexity of the design all influence the price. Regular follow-up care and adjustments are also factored into the overall cost.

Insurance Coverage for New Teeth Procedures

Insurance coverage for new teeth procedures can vary significantly between policies. Coverage often depends on the specific plan, the type of procedure, and the patient’s individual circumstances.

| Procedure | Typical Coverage | Common Exclusions | Potential Costs |

|---|---|---|---|

| Dental Implants | Partial coverage is common, often covering a portion of the implant cost and the abutment, but may exclude the crown or other restoration. | Many plans exclude cosmetic enhancements, pre-existing conditions, or excessive numbers of implants. | Significant out-of-pocket expenses are often required, particularly for multiple implants. |

| Dental Bridges | Similar to implants, partial coverage is common, often including a portion of the materials but excluding the crown. | Cosmetic enhancements, pre-existing conditions, and extensive restorations may not be covered. | Out-of-pocket costs depend on the number of teeth replaced and the materials used. |

| Dentures | Partial coverage for dentures is common, depending on the plan and the type of denture. | Cosmetic enhancements, excessive denture replacements, and pre-existing conditions may not be covered. | Out-of-pocket expenses may vary based on the complexity and materials used. |

Determining Insurance Coverage for Specific Cases

Understanding your insurance policy is crucial for managing dental expenses. Knowing precisely what your policy covers, and what it doesn’t, empowers you to make informed decisions about your dental care. This section delves into the specifics of reviewing your policy, finding crucial information, and effectively communicating with your insurer.Insurance policies, like any contract, are written in a way that’s meant to be unambiguous and clear.

However, they can sometimes be complex, leading to uncertainties about coverage. Thorough review and proactive communication with your insurer can prevent costly surprises down the road.

Reviewing Your Specific Insurance Policy Details

A thorough review of your insurance policy is paramount to understanding the specifics of your dental coverage. This involves meticulously examining the policy documents to identify the terms and conditions related to dental procedures. Look for clauses that Artikel the types of procedures covered, the percentage of costs reimbursed, and any limitations or exclusions.

Locating Relevant Information on Your Policy Document

Your policy document serves as a roadmap to your coverage. Specific sections will Artikel the details of your dental benefits. These sections often contain a glossary of terms that can help you understand the language used in the policy. Look for sections specifically labeled “Dental Benefits,” “Dental Procedures,” or similar titles. Be meticulous in your search; the information you need might be buried within several pages.

Detailed schedules and tables often Artikel coverage for different procedures, specifying the maximum benefit amounts and the percentages of costs reimbursed.

Contacting Your Insurance Provider for Clarification on Coverage, Does new teeth now take insurance

If you encounter ambiguities or need further clarification, contacting your insurance provider is the next step. A clear and concise communication is essential for effective clarification. Prepare your questions and requests in advance, ensuring they are specific and to the point.

Examples of Phrases to Use When Contacting the Insurance Provider

Here are some examples of phrases you can use when communicating with your insurance provider:

- “I am reviewing my dental insurance policy to understand coverage for [specific procedure, e.g., dental implants]. Could you please provide details on the percentage of costs covered?”

- “My policy mentions a maximum benefit amount for dental procedures. Could you please clarify the specific amount applicable to my policy?”

- “I am considering [specific dental procedure, e.g., root canal therapy]. Can you confirm if this procedure is covered under my plan?”

- “I am unclear about the exclusions listed in my dental plan. Could you please provide further details on procedures that are not covered?”

- “I’d like to understand the pre-authorization requirements, if any, for [specific dental procedure, e.g., orthodontics].”

Out-of-Pocket Costs and Payment Options: Does New Teeth Now Take Insurance

Navigating the financial aspects of new teeth procedures can be daunting. Understanding the potential out-of-pocket expenses and available payment options empowers patients to make informed decisions. This section delves into common costs, diverse payment plans, and the crucial role of pre-authorization in managing these expenses effectively.Dental procedures, especially those involving new teeth, can incur significant out-of-pocket costs. These costs are often influenced by the complexity of the procedure, the materials used, and the dentist’s fees.

Knowing what to anticipate is key to financial preparedness.

Common Out-of-Pocket Expenses

Dental insurance typically covers a portion of the cost, but the remaining balance falls to the patient. Common out-of-pocket expenses include co-pays, coinsurance, and deductibles. Co-pays are fixed amounts paid at the time of service, while coinsurance represents a percentage of the procedure cost. Deductibles are the amounts patients must pay before insurance coverage kicks in. These factors directly affect the patient’s out-of-pocket liability.

The patient’s portion of the cost can also vary depending on the complexity and scope of the treatment.

Payment Options

Several payment options can help manage the out-of-pocket costs. These options range from simple payment plans to more complex financing arrangements. Patients can choose the option that best suits their financial situation.

Financing Options

Dental financing plans offer a structured way to pay for procedures over time. These plans typically involve fixed monthly payments, similar to credit card or loan arrangements. Many dental practices offer in-house financing options, or patients can explore external financing providers. A key advantage is the ability to spread the cost over an extended period, making the procedure more manageable.

For example, a patient needing a full mouth reconstruction might opt for a financing plan to avoid a large, upfront payment.

Importance of Pre-Authorization and Pre-Determination of Benefits

Pre-authorization and pre-determination of benefits are crucial steps in managing out-of-pocket costs. Pre-authorization is a process where the insurance company reviews the proposed treatment to determine if it’s medically necessary and covered. Pre-determination of benefits provides an estimate of the amount the insurance company will cover. These processes can help patients anticipate and manage their out-of-pocket expenses more effectively.

By knowing the coverage details beforehand, patients can budget more accurately.

Examples of Financing Options

Several financing options are available. For instance, some dental practices partner with third-party providers that offer flexible payment plans. These plans can offer extended payment terms and potentially lower interest rates. Furthermore, some credit cards offer rewards or cash-back incentives that can be used to offset the costs. Understanding these options allows patients to choose the most suitable approach for their financial situation.

A patient seeking a dental implant might find a specific financing plan designed for dental implants beneficial.

Factors Affecting Insurance Coverage Decisions

Insurance coverage for new teeth procedures isn’t a simple yes or no. Numerous factors influence whether your policy will cover the cost. Understanding these factors is crucial for anticipating potential out-of-pocket expenses and making informed decisions about your dental care. This section delves into the complexities of coverage, examining the specific criteria insurers use to determine whether a procedure is eligible.A key element in navigating insurance coverage is recognizing that different insurance providers have varying criteria for coverage.

These criteria are often rooted in factors like the type of procedure, the specific materials used, and the overall cost of the treatment. Furthermore, the terms and conditions of your policy, and your specific medical history, significantly impact the final determination of coverage.

Influence of Procedure Type

Different types of new teeth procedures vary significantly in cost and complexity, impacting the likelihood of insurance coverage. Simple cosmetic procedures, like bonding or veneers, might have a different coverage rate compared to complex procedures like dental implants or dentures. Insurance companies often categorize procedures based on their necessity and perceived medical value. A procedure deemed purely cosmetic, lacking a clear restorative benefit, is less likely to be covered fully.

Comparison of Coverage Across Insurance Companies

Insurance companies employ different methodologies to assess and approve claims. Some insurers might have more stringent requirements for coverage than others. A procedure that’s covered by one company might not be by another. This disparity in coverage can be significant, highlighting the importance of thoroughly reviewing the policy documents and contacting the insurance provider directly with specific questions.

Role of Pre-existing Conditions

Pre-existing conditions can play a significant role in determining coverage for new teeth procedures. Policies often stipulate specific conditions under which procedures might be excluded or subject to limitations. A pre-existing condition, like gum disease, might affect the insurer’s assessment of the need for the procedure. Understanding how your pre-existing conditions might influence coverage is crucial in making informed choices about treatment.

Importance of Policy Terms and Conditions

Thoroughly reviewing your insurance policy’s terms and conditions is paramount. These documents Artikel specific procedures that are covered, excluded, or have limitations. It’s important to understand the policy’s definitions of “medically necessary,” “cosmetic,” and “restorative.” Specific exclusions and limitations regarding the cost of materials, or the extent of the procedure, should be carefully reviewed. Understanding these details will help you anticipate potential out-of-pocket costs and manage expectations accordingly.

Determining if new teeth now take insurance often depends on the specific dental procedure and your insurance plan. Factors like your employer’s benefits and the specifics of your Bank of New York Mellon salary bank of new york mellon salary might play a role in coverage. Ultimately, contacting your insurance provider is crucial for accurate information about coverage for new teeth.

Example of Insurance Coverage Differences

Consider two insurance policies. Policy A might cover dental implants if deemed medically necessary for restoration of function, but not purely cosmetic procedures. Policy B might cover a wider range of cosmetic procedures, including veneers, but have stricter criteria for coverage of more complex procedures like implants. The example illustrates the need for meticulous examination of the terms of each individual policy.

Understanding Provider Networks and In-Network Providers

Insurance plans often partner with specific dental practices to offer more affordable care. These partnerships are crucial for managing costs and ensuring smooth claims processing. Understanding these networks is vital for maximizing your dental insurance benefits.Understanding your insurance plan’s network of providers is paramount to receiving optimal value from your dental coverage. Knowing which dentists are in-network and which are out-of-network directly impacts your out-of-pocket expenses and the overall experience of your dental care.

Provider Networks Explained

Provider networks are groups of healthcare providers (like dentists) who have contracted with an insurance company. This agreement Artikels the terms of payment for services rendered to the insurance plan’s members. In essence, the insurance company has pre-negotiated fees with these providers to keep costs down for plan members.

In-Network Providers

In-network providers are dentists who are part of the insurance plan’s network. Using an in-network provider generally results in lower costs for dental procedures. This is because the insurance company and the provider have already agreed upon a maximum payment for services, which is typically lower than the fees charged by out-of-network providers.

Verifying Dentist Network Status

Confirming a dentist’s in-network status is essential before scheduling any procedures. Several methods are available to check. Firstly, your insurance company’s website often has an online directory or search tool. You can usually input the dentist’s name or location to see if they are part of the network. Secondly, your insurance plan’s customer service representatives can provide this information directly.

Thirdly, many dental practices will list their in-network status on their website or in their office. This information is vital to make informed decisions about your dental care.

Benefits of Using In-Network Providers

Using in-network providers offers significant advantages. These advantages can lead to a more efficient and cost-effective dental experience.

| Benefit | Explanation |

|---|---|

| Lower Costs | In-network providers typically charge fees that are pre-negotiated with the insurance company. This results in lower out-of-pocket costs for you, the patient. |

| Faster Claims Processing | Insurance companies often process claims faster for in-network providers, as the payment terms are already established. This streamlines the reimbursement process. |

| Reduced Out-of-Pocket Expenses | By choosing in-network providers, you can significantly reduce the amount you pay out-of-pocket for dental services. This can be particularly helpful for extensive dental work. |

| Improved Coverage | Using in-network providers usually results in more comprehensive coverage. The pre-negotiated fees typically align more closely with the benefits of your dental plan. |

Pre-authorization and Pre-determination of Benefits

Understanding pre-authorization and pre-determination of benefits is crucial for navigating dental insurance. These processes are essential steps in ensuring your dental procedures are covered and that you understand your financial obligations. Pre-authorization, in essence, is your insurance company’s approval for a particular procedure, while pre-determination estimates the cost of the procedure.Pre-authorization and pre-determination of benefits are vital tools for both patients and insurance companies.

They help streamline the claims process, enabling patients to anticipate potential out-of-pocket costs and insurance companies to manage their expenditures. A well-defined process minimizes surprises and facilitates a smoother transition from treatment planning to actual treatment.

Purpose of Pre-authorization and Pre-determination

Pre-authorization is a crucial step for new teeth procedures. It verifies if the procedure is covered under your insurance plan and whether the dentist or dental facility is in-network. Pre-determination estimates the amount your insurance will pay for the specific procedure. This allows you to budget effectively and understand the total financial commitment. Pre-authorization and pre-determination empower you to make informed decisions about your treatment plan.

Process of Obtaining Pre-authorization for New Teeth Procedures

The pre-authorization process typically involves submitting a request to your insurance company. This request often needs to include specific information about the proposed procedure. You’ll need to provide details about the planned treatment, the dentist performing the procedure, and the estimated cost. The insurance company will then review your request and confirm if the procedure is covered and what the coverage details are.

- The process often begins with contacting your insurance provider to understand their specific pre-authorization requirements. This usually involves obtaining the necessary forms and submitting them through a designated portal or by mail.

- Accurate and comprehensive documentation is critical. The pre-authorization request should contain all relevant details, such as the type of procedure, the date of the procedure, and the dentist’s information.

- Your insurance company will review your request and respond within a specified timeframe. The response typically includes an approval or denial, along with any necessary conditions or further steps.

- If the procedure is approved, the pre-authorization number will be crucial for processing the claim.

Importance of Timely Pre-authorization Requests

Timely pre-authorization requests are crucial for several reasons. First, they help ensure that your treatment plan aligns with your insurance coverage. Second, timely requests avoid potential delays in your treatment, as approval might be needed before the treatment begins. Third, it allows for adequate time to explore options if the procedure isn’t covered or the cost exceeds your budget.

Examples of Documents Required for Pre-authorization

The specific documents required for pre-authorization vary based on the insurance provider. However, common documents often include:

- A detailed description of the proposed procedure.

- The dentist’s name, address, and credentials.

- Your insurance policy information.

- A copy of the treatment plan or any diagnostic images.

- Any previous dental records.

Closing Notes

In conclusion, understanding insurance coverage for new teeth procedures is crucial for proactive dental care. This guide has provided a framework for navigating the complexities of insurance policies, procedure costs, and payment options. Remember to thoroughly review your policy details, consult with your dentist, and explore available financing options to make well-informed decisions about your oral health journey. With careful consideration and planning, you can successfully manage the financial aspects of these significant procedures.

Commonly Asked Questions

What are the typical out-of-pocket expenses associated with new teeth procedures?

Out-of-pocket expenses can vary significantly depending on the procedure, your insurance plan, and your dentist. Deductibles, co-pays, and potentially even a percentage of the procedure cost beyond the coverage limit are factors to consider. Thoroughly reviewing your policy is key to understanding your potential financial responsibilities.

How can I determine if a specific dentist is in my insurance network?

Verify your dentist’s participation in your insurance network by contacting your insurance provider directly or using online tools provided by your insurance company. They can often provide a list of in-network dentists.

What is the process for obtaining pre-authorization for new teeth procedures?

Pre-authorization procedures vary depending on your insurance plan. Often, you’ll need to contact your insurance provider and request pre-authorization for the specific procedure. Your dentist can guide you through this process, often providing necessary forms or documentation.

Does my pre-existing condition affect my coverage for new teeth procedures?

Pre-existing conditions can sometimes influence coverage decisions, although this is not always the case. Review your policy terms carefully for details on pre-existing conditions and how they might affect your specific coverage. Contacting your insurance provider directly is advisable to get clarification.