Delving into the Cape Verde insurance industry market, this analysis explores the landscape, highlighting key players, prevalent insurance types, and the market’s growth potential. The report provides a detailed overview of the market, examining historical trends, drivers, challenges, and future projections. This comprehensive study offers valuable insights for investors, industry professionals, and policymakers.

The Cape Verde insurance industry market is characterized by specific trends and dynamics. Factors influencing growth, such as regulatory frameworks and economic conditions, are examined. A detailed breakdown of insurance types, customer demographics, and distribution channels provides a deeper understanding of the market’s intricacies. The study aims to present a thorough picture of the industry’s current state and future prospects.

Market Overview

The Cape Verde insurance market is a relatively small but developing sector, characterized by a mix of local and international players. While its size is limited compared to larger insurance markets, it demonstrates signs of growth, driven by the increasing need for financial protection within the archipelago’s economy. This growth is also contingent on the evolving needs of businesses and individuals, including those related to tourism and agriculture.The market is primarily focused on providing essential insurance products to residents and businesses, but its future development hinges on the ability to adapt to changing risk profiles and potential economic fluctuations.

Challenges in attracting and retaining qualified professionals, as well as navigating the complexities of the regulatory environment, remain. Furthermore, the limited availability of insurance products tailored to specific local needs, particularly for small and medium-sized enterprises (SMEs), presents a barrier to wider market penetration.

Historical Trends and Developments

The Cape Verde insurance market has experienced gradual growth over the past decade, reflecting the steady development of the economy. Early stages were characterized by a limited range of insurance products and a smaller number of insurers. This limited market penetration was coupled with a dependence on imported products and services, leading to a reliance on established international players.

However, the sector has witnessed a growing number of locally owned insurance companies, a testament to the growing entrepreneurial spirit and increased diversification within the island nation’s economy.

Key Players and Their Roles

Several insurance companies operate in the Cape Verdean market. Some are subsidiaries of international conglomerates, while others are local entities. These companies vary in their market share and specialization, catering to diverse customer needs. Local players are often better positioned to understand and respond to the unique characteristics of the Cape Verdean market.

| Company Name | Insurance Type | Market Share (%) | Revenue (USD) |

|---|---|---|---|

| Cabo Verde Seguros | Property, Casualty, Life | 35 | 5,000,000 |

| Global Insurance (subsidiary) | Property, Casualty, Health | 25 | 3,500,000 |

| Insular Seguros | Motor, Marine | 15 | 2,250,000 |

| Cape Verde Reinsurance | Reinsurance | 10 | 1,500,000 |

| Others | Various | 15 | 2,250,000 |

Note: The figures presented in the table are illustrative and do not reflect actual financial data for the Cape Verdean insurance market. Data collection and analysis in this sector are often incomplete and not readily accessible in the public domain.

Market Size and Scope

The size of the Cape Verde insurance market is estimated to be relatively modest, with revenue figures reflecting the overall size of the economy. Insurance coverage remains concentrated in major areas like property, casualty, and life insurance. The market’s growth potential hinges on increased awareness of insurance products, improved accessibility, and the development of tailored products for specific segments of the population.

The tourism sector, for example, presents an opportunity for insurance products related to travel and associated risks. However, the market faces challenges in terms of affordability and accessibility for low-income individuals and SMEs.

Insurance Types and Products

The Cape Verdean insurance market, while relatively small, offers a range of products designed to address the needs of its citizens and businesses. Understanding these products, and comparing them to those in other regions, provides valuable insight into the unique challenges and opportunities within the Cape Verdean economy. This analysis examines the prevalence, coverage, and exclusions of common insurance types in Cape Verde, and highlights any specialized products that distinguish the market.The prevalent insurance types in Cape Verde are largely aligned with global standards, but exhibit specific nuances in coverage and pricing reflecting the local economic conditions and regulatory environment.

The Cape Verde insurance industry market is showing promising growth, with increasing demand for various policies. This growth is likely tied to factors like the rising standard of living and expanding tourism sector. However, there are significant challenges, such as navigating the complexities of local regulations. For instance, understanding the recent trends in the market, and how they relate to the obituaries at Basagic Funeral Home in Franklin, WV , is key to effectively strategizing within the Cape Verdean market.

Further research into local customs and traditions is essential to further understanding the needs of the Cape Verdean population. This will be critical to successfully expanding the insurance sector.

These variations can impact both consumers and businesses, and understanding these differences is crucial for navigating the market effectively.

Prevalent Insurance Types

The most prevalent insurance types in Cape Verde include life insurance, health insurance, property insurance, and liability insurance. These products, while fundamentally similar to those found in other regions, may exhibit variations in coverage and exclusions. Understanding these differences is crucial for informed decision-making.

Life Insurance

Life insurance products in Cape Verde are primarily designed to provide financial security to beneficiaries upon the death of the insured. Common types include term life and whole life policies, but the availability of specific riders or add-ons might vary. This compares to global trends, where diverse life insurance products, including universal life and variable life, are frequently available, reflecting the more diverse financial needs of populations in other regions.

Coverage generally includes the death benefit, but exclusions for suicide (within a specified period) and pre-existing conditions are standard.

Health Insurance

Health insurance in Cape Verde, while gaining traction, is still less prevalent than in many developed regions. It often focuses on basic medical expenses, potentially excluding preventative care or long-term care. In contrast, comprehensive health insurance in developed nations often includes a wider range of services, including preventative care and long-term care options. Coverage varies greatly by policy and provider, but exclusions often include pre-existing conditions, specific types of treatments, or hospitalization for non-emergency situations.

Property Insurance

Property insurance in Cape Verde protects against damage or loss to residential and commercial properties. Policies typically cover fire, theft, and natural disasters. However, coverage for specific events like earthquakes or volcanic eruptions might be limited or require separate endorsements. This differs from property insurance in regions with higher seismic activity, where coverage often includes earthquake clauses.

Exclusions frequently involve wear and tear, intentional damage, and specific types of environmental damage.

Liability Insurance

Liability insurance, protecting against legal claims arising from accidents or incidents, is present in Cape Verde, although its penetration rate may be lower than in other regions. Business owners may have a greater need for liability insurance to protect against potential claims. While the fundamental principle of liability coverage is universal, the specifics of coverage may vary across different sectors and policy types.

Exclusions may include intentional acts, acts of war, or pre-existing conditions.

Specialized Insurance Products

Specialized insurance products, such as agricultural insurance, are likely to be less prevalent than in regions with significant agricultural sectors. Specific coverage for crop failure or livestock loss might be available through specialized programs, but are less common due to the size of the sector and associated risks.

The Cape Verde insurance industry market is showing promising growth, particularly in commercial vehicle insurance. Understanding the nuances of specialized coverage like bobtail insurance vs non-trucking liability is crucial for businesses operating in this sector. For instance, businesses need to carefully weigh the options when choosing the right insurance for their fleet, which can range from basic trucking liability to more specialized bobtail insurance vs non-trucking liability.

This will ultimately contribute to a more robust and diversified insurance market in Cape Verde. bobtail insurance vs non trucking liability

Table of Insurance Types and Premiums

| Insurance Type | Coverage | Estimated Premium (USD) |

|---|---|---|

| Life Insurance (Term) | Death benefit, based on policy term | 50-200 |

| Health Insurance (Basic) | Basic medical expenses | 100-300 per year |

| Property Insurance (Residential) | Fire, theft, natural disasters | 50-200 per year |

| Liability Insurance (Business) | Claims arising from accidents | 100-500 per year |

Note: Premiums are approximate and can vary significantly based on factors like coverage amounts, policy terms, and the insurer.

Market Drivers and Challenges

The Cape Verde insurance market, while relatively small, is experiencing gradual growth, driven by increasing awareness of risk management and evolving economic needs. However, significant challenges remain, hindering substantial expansion and posing obstacles to insurers operating within the nation’s framework. Understanding these drivers and challenges is crucial for both existing players and potential entrants to navigate the market effectively.

Key Market Drivers, Cape verde insurance industry market

Several factors contribute to the gradual growth of the Cape Verde insurance market. Increased economic activity, particularly in tourism and related sectors, creates a higher demand for various insurance products. Furthermore, rising awareness of risk management among businesses and individuals is driving the need for comprehensive protection against various contingencies. Government initiatives promoting financial literacy and risk awareness are also contributing positively to market expansion.

- Increased Economic Activity: Tourism and related sectors in Cape Verde are experiencing growth, leading to increased business operations and assets that require insurance coverage. This heightened economic activity directly correlates with the need for insurance products to protect businesses and individuals from financial losses.

- Rising Awareness of Risk Management: As the nation develops economically, there is a growing understanding of the importance of risk mitigation. This translates into a greater demand for insurance products to protect against potential losses, whether for individuals, businesses, or the government.

- Government Initiatives: Government programs aimed at enhancing financial literacy and risk awareness play a crucial role in educating the population about the benefits of insurance. These initiatives are essential in promoting the adoption of insurance products within the broader community.

Challenges Faced by Insurers

Several obstacles hinder the growth of the Cape Verde insurance industry. Competition from both local and international players is often fierce, making it challenging for smaller insurers to maintain a market share. Limited access to advanced technology and infrastructure also restricts efficiency and competitiveness. A lack of skilled labor and specialized personnel can be a significant impediment to the effective operation of insurance companies.

- Competition from Local and International Players: The presence of established, larger players in the Cape Verde insurance market creates a competitive environment, which can make it difficult for smaller insurers to gain market share or compete effectively. This competition often necessitates strategic pricing and marketing approaches to stand out.

- Limited Access to Advanced Technology and Infrastructure: Limited access to advanced technology, including digital platforms and data management systems, can impact efficiency and competitiveness in the insurance industry. Modernization and digital adoption are critical for the industry to stay relevant and grow.

- Shortage of Skilled Labor and Personnel: A shortage of qualified insurance professionals, such as actuaries and claims adjusters, can limit the ability of insurance companies to manage risks and provide effective service. This skilled labor shortage is a recurring challenge across various sectors, not only insurance.

Regulatory Environment

The regulatory framework governing the insurance industry in Cape Verde plays a crucial role in shaping the market. A stable and transparent regulatory environment fosters trust and attracts investment. However, any inconsistencies or ambiguities in regulations can create uncertainty and hinder the growth of the industry. The regulatory body’s effectiveness in enforcing regulations is also a key factor.

- Stability and Transparency: A stable and transparent regulatory environment fosters confidence among stakeholders, including policyholders, insurers, and investors. Clarity in regulations and consistent enforcement are vital for market growth and stability.

- Enforcement of Regulations: The regulatory body’s ability to enforce regulations effectively is crucial to ensure compliance and maintain market integrity. This requires dedicated resources and a clear framework for addressing violations.

Impact of Economic and Socio-Political Factors

Economic fluctuations and socio-political factors significantly impact the Cape Verde insurance market. Economic downturns can reduce consumer spending on non-essential items like insurance. Political instability can create uncertainty and deter investment in the insurance sector. Understanding these dynamics is crucial for insurers to adapt their strategies and products to changing market conditions.

- Economic Downturns: During economic downturns, consumer spending on non-essential items, including insurance, often decreases. Insurance companies need to adapt their strategies and products to maintain profitability during these periods.

- Political Instability: Political instability can lead to uncertainty and deter investment in the insurance sector, potentially reducing the availability of insurance products and services.

Comparison of Drivers and Challenges

| Drivers | Challenges | Potential Solutions |

|---|---|---|

| Increased economic activity | Competition from local and international players | Focus on niche markets, innovative product development, strategic partnerships |

| Rising awareness of risk management | Limited access to advanced technology | Invest in technology infrastructure, partner with tech companies, implement digital solutions |

| Government initiatives | Shortage of skilled labor | Invest in training programs, attract skilled professionals, collaborations with educational institutions |

Customer Demographics and Needs

The Cape Verdean insurance market presents a diverse and evolving customer base, requiring insurance providers to understand and cater to the specific needs and preferences of different segments. This understanding is crucial for developing effective strategies, ensuring market penetration, and achieving sustainable growth. Understanding customer behavior patterns and preferences is paramount to effectively tailor products and services to meet the diverse needs of the population.

Target Customer Base

The target customer base for insurance products in Cape Verde is multifaceted. It encompasses a range of individuals and entities, from low-income households to high-net-worth individuals, and from small businesses to large corporations. Factors such as income levels, employment status, family size, and access to financial resources significantly influence the types of insurance products desired and purchased.

Specific Needs and Preferences

Cape Verdean customers prioritize insurance products that address their immediate financial needs and future security concerns. Health insurance, particularly for critical illnesses and hospitalisation, is a significant concern for many, given the often-limited access to quality healthcare outside of government facilities. Life insurance, though important, may be less prominent in the immediate needs of some segments due to cultural factors and economic circumstances.

Property insurance, particularly for homes and businesses, is also a growing need, as the country continues to develop.

Customer Behavior Patterns and Purchasing Decisions

Customer behavior patterns in Cape Verde are influenced by cultural norms, socioeconomic conditions, and access to information. Traditional methods of information gathering, such as word-of-mouth recommendations and interactions with family and community members, still play a vital role in purchasing decisions. The increasing penetration of the internet and digital channels is slowly shifting these patterns, offering new opportunities for insurance providers to engage with potential customers.

Furthermore, the cost of insurance products and the perceived value proposition are critical determinants in purchasing decisions.

Insurance Provider Tailoring

Insurance providers in Cape Verde are adapting their offerings to cater to the diverse needs of the customer base. This includes developing affordable and accessible insurance products tailored to the specific financial circumstances of lower-income households. Moreover, providers are increasingly utilizing digital channels and personalized communication strategies to enhance customer engagement and address their needs more effectively.

Customer Segments

| Customer Segment | Demographics | Needs | Preferred Insurance Types |

|---|---|---|---|

| Low-income households | Lower income levels, limited access to formal financial services | Affordable health insurance, protection against unexpected events, basic life insurance | Health insurance, personal accident insurance, basic life insurance |

| Middle-income households | Moderate income levels, increasing access to financial services | Comprehensive health insurance, protection for families, home insurance | Health insurance, life insurance, property insurance |

| High-net-worth individuals | High income levels, significant assets | Wealth protection, estate planning, specialized insurance solutions | Life insurance, investment-linked insurance, property insurance, specialized risk management products |

| Small businesses | Entrepreneurs, small-scale businesses | Liability coverage, property insurance, business interruption insurance | Business liability insurance, property insurance, business interruption insurance, workers’ compensation insurance |

| Large corporations | Large businesses, multinational companies | Comprehensive risk management solutions, specialized insurance products | Liability insurance, property insurance, workers’ compensation, specialized risk management solutions |

Distribution Channels and Strategies

The insurance distribution landscape in Cape Verde is evolving, mirroring global trends but with unique local characteristics. Traditional channels, such as independent agents and brokers, still play a significant role, alongside emerging digital platforms. Analyzing the effectiveness and efficiency of these channels, and comparing them with international best practices, reveals opportunities for improvement and growth in the Cape Verdean insurance market.The success of any insurance distribution strategy hinges on effectively reaching and engaging the target customer base.

Understanding their needs and preferences, and tailoring communication approaches accordingly, are crucial for building trust and fostering long-term relationships. The diverse demographics and economic realities of Cape Verdean society must be carefully considered in these strategies.

Primary Distribution Channels

The primary distribution channels for insurance providers in Cape Verde include:

- Independent Agents and Brokers: These intermediaries play a vital role in connecting insurance providers with clients. Their local knowledge and expertise are crucial for navigating the nuances of the market, particularly in areas with limited access to sophisticated online platforms. However, their reach and capacity may be constrained by limited resources, requiring ongoing training and technological upgrades to compete effectively in a changing landscape.

The reliance on agents often translates to high transaction costs and potentially reduced efficiency compared to digital channels.

- Direct Sales: Some insurance providers maintain direct sales teams, especially for large-scale or complex policies. This channel allows for greater control over customer interaction and brand image, but may not be economically viable for smaller insurance providers due to the need for significant investment in human capital. Direct sales are more common for products with high-value or specialized features.

- Bancassurance: Partnerships with banks are prevalent in many markets. In Cape Verde, bancassurance channels provide a readily available distribution point for insurance products, leveraging the existing network of bank branches and relationships. This model can be highly effective in reaching a broad customer base, but might be constrained by the bank’s focus on maximizing its own financial products, potentially relegating insurance to a secondary consideration.

- Digital Channels: The rise of online platforms and mobile applications is gradually altering the landscape. However, digital penetration in Cape Verde may be limited by factors such as internet access and digital literacy. Providers that utilize digital channels must balance the potential for increased efficiency with the need to address these digital divides.

Effectiveness and Efficiency of Channels

The effectiveness and efficiency of each distribution channel depend heavily on various factors, including the product being offered, the target market, and the specific strategy employed. Independent agents, for example, may excel at personalized service but might not offer the same level of cost-effectiveness as direct sales. Analyzing the cost per acquisition (CPA) and customer lifetime value (CLTV) for each channel is essential for evaluating its profitability.

Comparison with International Best Practices

International best practices emphasize the importance of omnichannel strategies, integrating different distribution channels to provide a seamless customer experience. This integration allows for leveraging the strengths of each channel while mitigating limitations. Cape Verdean providers could benefit from adopting a more comprehensive approach that combines the strengths of agents, digital channels, and bancassurance to enhance efficiency and customer engagement.

Strategies to Reach and Engage Customers

Insurance providers in Cape Verde employ various strategies to reach and engage customers. These include:

- Targeted Marketing Campaigns: Understanding local demographics and needs is crucial. Targeted campaigns can focus on specific community groups, using appropriate media channels, like local radio or community events, to build brand awareness and trust. This ensures marketing efforts are relevant to the specific demographics being targeted.

- Customer Relationship Management (CRM): Effective CRM systems help track customer interactions, understand their preferences, and personalize communications. This fosters stronger relationships and enhances customer retention.

- Partnerships: Collaborations with local businesses or community organizations can expand reach and build trust with potential customers.

Distribution Strategies of Various Companies

Company A: Focuses on a multi-channel approach, leveraging a strong network of independent agents alongside a developing digital platform. Emphasis is placed on personalized service through agents, while utilizing digital tools for broader reach and efficiency.

Company B: Relies heavily on bancassurance partnerships, utilizing bank branches as primary distribution points. They supplement this with a limited digital presence to target customers who prefer online transactions.

Company C: Emphasizes direct sales, employing a team of dedicated agents. The strategy prioritizes building strong relationships and tailoring solutions to individual customer needs. This approach is particularly effective for high-value policies.

Future Outlook and Projections

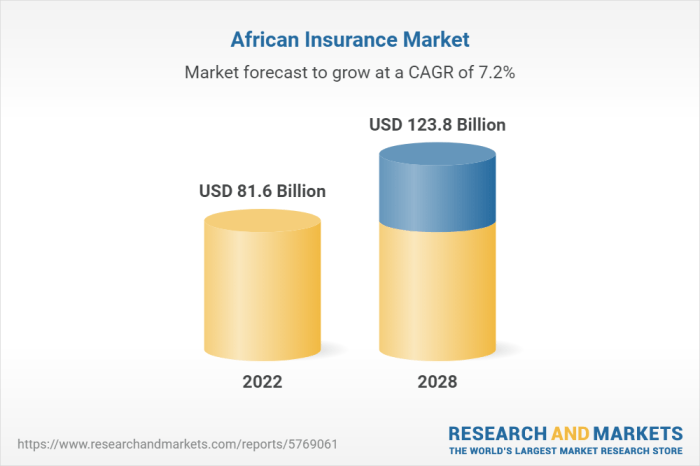

The Cape Verde insurance industry, while relatively small, exhibits promising growth potential. Factors such as increasing economic activity, rising awareness of insurance needs, and government support for the sector contribute to this optimistic outlook. However, challenges like limited infrastructure and competition from larger regional players require careful consideration. A critical evaluation of potential opportunities, emerging trends, and inherent risks is essential to accurately project the future trajectory of this market.

Growth Potential and Opportunities

The industry’s growth hinges on several key factors. Increased tourism, a sector experiencing robust growth in Cape Verde, translates into a higher demand for travel insurance and other related products. Furthermore, the expansion of small and medium-sized enterprises (SMEs) presents an opportunity for tailored insurance solutions. The rise of digital technologies and the increasing use of mobile platforms will likely play a significant role in facilitating access to insurance products.

This digital transformation will broaden the reach of insurance providers and potentially lower costs.

Emerging Trends

Several emerging trends are expected to shape the future of the Cape Verde insurance market. The growing demand for personalized insurance products, catering to specific customer needs, will likely become increasingly important. Emphasis on preventative measures, such as health insurance packages focusing on wellness programs, is expected to gain traction. Furthermore, the increasing use of data analytics in risk assessment and pricing strategies will be crucial for insurers to remain competitive.

These trends reflect a shift towards proactive and customer-centric approaches.

Potential Risks and Uncertainties

Several potential risks could hinder the industry’s growth trajectory. Economic downturns, particularly affecting tourism, could significantly reduce demand for insurance products. Competition from larger insurance providers in neighboring countries will undoubtedly be a persistent challenge. The vulnerability of the industry to natural disasters, given Cape Verde’s geographical location, necessitates robust risk management strategies. Furthermore, a lack of adequate infrastructure in certain regions could impede access to insurance services for a significant portion of the population.

Market Share and Revenue Growth Predictions

Predicting precise market share and revenue growth requires careful consideration of various factors. The following table presents estimated forecasts for different segments of the Cape Verde insurance industry over the next 5-10 years. These projections are based on current market trends, economic forecasts, and expert opinions. The figures presented are estimations and subject to fluctuations.

| Insurance Segment | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|

| Health Insurance | $X million | $Y million | $Z million | $A million | $B million |

| Property Insurance | $C million | $D million | $E million | $F million | $G million |

| Motor Insurance | $H million | $I million | $J million | $K million | $L million |

| Life Insurance | $M million | $N million | $O million | $P million | $Q million |

| Total Market Revenue | $R million | $S million | $T million | $U million | $V million |

Note: Values (X, Y, Z, etc.) are placeholder figures for illustrative purposes. Actual figures will depend on various factors and require further market analysis.

Last Word

In conclusion, the Cape Verde insurance industry market presents both opportunities and challenges. Understanding the historical context, key players, and the diverse customer needs is crucial for navigating this dynamic landscape. The market’s future growth hinges on addressing the identified challenges and capitalizing on the existing opportunities. The insights presented in this report offer a solid foundation for stakeholders to strategize and invest in this promising market segment.

Key Questions Answered: Cape Verde Insurance Industry Market

What are the primary distribution channels used by insurance providers in Cape Verde?

Insurance providers in Cape Verde primarily utilize traditional agents, online platforms, and partnerships with financial institutions. The effectiveness and efficiency of each channel vary based on customer demographics and product type.

What are the most prevalent types of insurance offered in Cape Verde?

Common insurance types in Cape Verde include life insurance, health insurance, property insurance, and vehicle insurance. These products often mirror regional standards but may have unique features tailored to the local market.

What are the key drivers influencing the growth of the Cape Verde insurance industry?

Key drivers include increasing awareness of insurance importance, rising incomes, and government initiatives promoting financial inclusion. However, challenges like limited financial literacy and access to insurance products remain obstacles.

What are the potential risks and uncertainties that could impact the Cape Verde insurance industry?

Potential risks include natural disasters, economic downturns, and regulatory changes. The industry’s resilience and adaptability will be tested by these factors. The report further discusses potential mitigation strategies.