Is Medicare cheaper than employer insurance? This crucial question requires a nuanced understanding of individual circumstances, plan specifics, and long-term financial implications. Analyzing the costs and coverage of both options is essential for informed decision-making.

A comprehensive comparison considers various factors like premiums, deductibles, co-pays, and the types of services covered. Individual health needs, employment benefits, and future health projections also play a significant role. This exploration will provide a detailed overview to help individuals navigate this complex choice.

Factors Affecting Medicare Costs

Understanding the intricacies of Medicare costs is crucial for anyone considering or already enrolled in the program. While the general concept of Medicare being a government-funded program might suggest a straightforward cost structure, several factors significantly influence the price tag of individual plans. These factors often differ from the typical cost structure of employer-sponsored insurance, adding another layer of complexity to the decision-making process.Medicare plans, unlike employer-sponsored insurance, are not directly tied to an individual’s employment.

This independence introduces a greater variety in pricing models, with factors such as individual health conditions and geographic location playing a more prominent role in determining the final cost.

Factors Influencing Medicare Plan Costs

Medicare plan costs are influenced by a variety of factors, many of which are unique to the program and not necessarily present in employer-sponsored insurance. These include, but are not limited to, the specific benefits included in a plan, the geographic location of the enrollee, and the level of health care utilization projected for the enrollee.

- Plan Benefits and Coverage: Different Medicare plans offer varying levels of coverage for specific services, which directly impact the cost. For example, plans with broader coverage for specialized treatments or preventive care might have higher premiums. Employer-sponsored plans often offer more predictable coverage based on the company’s benefit package, though costs may vary based on the employee’s choice of coverage.

- Geographic Location: The cost of healthcare services can differ significantly across regions. Higher costs in certain areas often translate to higher premiums for Medicare plans in those locations. This is a key difference from employer-sponsored plans, where the cost is often set based on a broader region or nationwide average.

- Health Status and Projected Healthcare Utilization: Individuals with pre-existing conditions or those anticipated to require more extensive medical care often face higher premiums. Predicting healthcare needs is more difficult in the absence of an employer’s data and history of healthcare utilization.

- Provider Network: The quality and accessibility of healthcare providers in a given network can affect plan costs. Plans with a wide range of providers, or those located in areas with fewer providers, often have different cost structures. This aspect is less prominent in employer-sponsored plans, which usually have a pre-selected network of providers.

Components of Medicare Costs

Understanding the various components of Medicare costs is essential for a clear picture of the overall financial commitment.

- Premiums: These are the monthly payments made to maintain coverage under a Medicare plan. Premiums can differ significantly depending on the plan chosen, with some plans offering lower premiums but potentially higher deductibles or co-pays.

- Deductibles: A deductible is the amount an individual must pay out-of-pocket for covered services before the insurance plan begins to pay. This amount varies widely across different plans.

- Co-pays: Co-pays are fixed amounts paid by the enrollee for specific medical services, such as doctor visits or prescription drugs. Co-pays, too, differ substantially between Medicare plans.

Comparing Medicare Plan Costs

The cost of Medicare plans can vary considerably depending on the chosen plan.

| Plan Type | Average Premium (estimated) | Average Deductible (estimated) | Average Co-pay (estimated) | Employer Insurance Comparison |

|---|---|---|---|---|

| Medicare Advantage | $50-$100+ | $0-$1000+ | $10-$20+ | Can be similar or higher, depending on the plan and employer |

| Medicare Supplement (Medigap) | $50-$100+ | N/A | Variable | Typically not a direct comparison; supplemental to employer insurance |

| Medicare Part D (Prescription Drug) | $0-$100+ | N/A | Variable | Often offered through employer plans; premiums may vary significantly |

Note: These are estimated values and can vary widely based on the specific plan and individual circumstances. Consult with a Medicare advisor for personalized cost estimations.

Factors Affecting Employer Insurance Costs

Employer-sponsored health insurance premiums are a significant cost for businesses, and understanding the factors that influence these costs is crucial for effective budgeting and strategic decision-making. Various elements play a role in determining the price tag, making it a complex issue. This analysis delves into the key contributors, including the size of the company, the location of its operations, and the demographics of its workforce.Understanding these factors allows employers to make informed decisions about their benefit packages, optimize costs, and ensure their employees have access to adequate health insurance.

The analysis will also cover the components of these costs, including premiums, deductibles, and co-pays, and provide illustrative examples of how different benefit packages affect insurance costs.

Employer Size and Insurance Premiums

The size of an employer significantly impacts the cost of health insurance. Larger companies typically have more employees, and the larger pool of enrollees often results in lower premiums per employee. This is due to the spreading of risk across a larger population. Smaller companies face higher premiums as they carry a smaller, less diversified risk pool.

Negotiating with insurance providers for favorable rates becomes more challenging for smaller businesses. For example, a small startup with 20 employees might pay substantially more per employee than a large corporation with 10,000 employees for the same coverage.

Geographic Location and Insurance Costs

The geographic location of an employer’s business can influence insurance premiums. Regions with higher healthcare costs, like those with a higher concentration of specialized medical facilities and higher physician fees, typically have higher insurance premiums. For example, health insurance costs in major metropolitan areas like New York City or San Francisco are often significantly higher than in rural areas or smaller towns.

This is due to factors such as the higher cost of living, higher demand for medical services, and the presence of specialized healthcare providers.

Employee Demographics and Premiums

The demographics of an employer’s workforce also play a critical role in determining insurance premiums. Factors like age, health status, and lifestyle choices influence the likelihood of an employee requiring medical attention. A workforce with a higher proportion of older employees, or employees with pre-existing conditions, will typically lead to higher premiums. For instance, a company with a large percentage of employees over 55 might face higher premiums than a company with a younger workforce.

This is because older individuals are statistically more likely to require more expensive healthcare services.

Components of Employer Insurance Costs

Employer health insurance costs encompass various components, including premiums, deductibles, and co-pays. Premiums are the regular payments made to the insurance company. Deductibles are the amount an employee must pay out-of-pocket before the insurance company begins to cover expenses. Co-pays are fixed amounts paid by the employee for specific medical services, like doctor visits or prescriptions.

The interplay of these components significantly affects the overall cost of employer-sponsored health insurance.

Examples of Varying Benefit Packages

Different employer benefit packages have a substantial impact on insurance costs. A comprehensive plan with lower deductibles and co-pays, including a wider range of covered services, will typically result in higher premiums compared to a plan with higher deductibles and co-pays. A plan offering wellness programs and preventative care may result in lower long-term costs due to reduced healthcare utilization.

For example, a plan including preventative care like annual checkups might result in lower costs over time compared to a plan that only covers emergency care.

Average Employer Insurance Costs Across Industries

| Industry | Average Annual Premium (per employee) |

|---|---|

| Technology | $15,000 |

| Healthcare | $18,000 |

| Retail | $12,000 |

| Manufacturing | $10,000 |

| Education | $14,000 |

Note: These are illustrative figures and may vary based on specific factors within each industry.

Comparing Medicare and Employer Insurance Coverage

Choosing between Medicare and employer-sponsored insurance can be a significant decision, often hinging on individual circumstances and needs. Understanding the similarities and differences in coverage is crucial for making an informed choice. Both aim to protect against healthcare costs, but their approaches and specific benefits vary considerably.Medicare and employer insurance plans share some common ground in providing essential healthcare services.

Both typically cover preventive care, like checkups and immunizations, and often include hospitalizations and physician visits. However, the extent of coverage and the specific services included differ substantially.

Similarities in Coverage

Medicare and employer plans often share some core benefits. Both commonly cover preventive care, doctor visits, and hospitalizations. These foundational elements represent areas where both insurance types overlap and provide a degree of baseline healthcare protection. The details and extent of these benefits, however, can vary significantly.

Differences in Coverage

The crucial distinctions lie in the breadth and depth of coverage offered. Employer plans frequently provide more comprehensive benefits, often including vision, dental, and sometimes even mental health care. Medicare, while robust in its core benefits, might not cover these additional services without supplemental plans.

Types of Services Covered

Medicare primarily focuses on hospital care, physician services, and some preventive care. Employer plans often extend this coverage to include a broader spectrum of services, potentially encompassing vision, dental, and mental health care. The specific inclusions depend on the individual plan.

Specific Conditions or Treatments

Medicare, due to its focus on the needs of seniors and those with specific health conditions, generally covers essential treatments and conditions. However, employer plans may offer greater flexibility and more comprehensive options for specific conditions or treatments. For instance, specialized therapies or advanced medical equipment may be more readily covered by employer plans.

Limited Coverage in Medicare

Medicare may have limitations in coverage for certain services or treatments. Examples include some types of experimental treatments, long-term care, and certain types of mental health care, which may not be fully covered or require supplemental insurance.

Figuring out if Medicare is cheaper than employer insurance depends on your specific situation. But if you’re looking for a place to strategize your healthcare plan, consider booking a meeting room near Cincinnati airport. Meeting rooms near Cincinnati airport offer great options for brainstorming and potentially finding the best healthcare solution for your budget. Ultimately, researching your options and understanding your needs is key to deciding if Medicare is the right financial choice for you.

Limited Coverage in Employer Insurance

Employer plans, while often comprehensive, may have exclusions or limitations. Some plans might not fully cover specific treatments or conditions, or may have higher deductibles or co-pays compared to Medicare.

Coverage Differences Table

| Coverage Area | Medicare | Employer Insurance |

|---|---|---|

| Hospitalization | Generally Comprehensive | Generally Comprehensive |

| Physician Services | Generally Comprehensive | Generally Comprehensive |

| Preventive Care | Generally Comprehensive | Generally Comprehensive |

| Dental Care | Limited or absent | Often Included or Available as an add-on |

| Vision Care | Limited or absent | Often Included or Available as an add-on |

| Mental Health Care | Limited, often requiring supplemental plans | Often Included or Available as an add-on |

| Long-Term Care | Limited | Often Included or Available as an add-on |

Medicare Eligibility and Enrollment

Navigating the world of healthcare can be daunting, especially when it comes to understanding the complexities of Medicare. This section dives into the specifics of who qualifies for Medicare, the crucial enrollment periods, and how these factors influence the cost comparison between Medicare and employer-sponsored insurance. Understanding these details is key to making an informed decision about your healthcare coverage.

Medicare Eligibility Requirements

Medicare eligibility is based on specific criteria. A fundamental requirement is age. Generally, those aged 65 and older are eligible, though exceptions and special circumstances exist. Another crucial factor is work history. Individuals who have paid into Social Security for a certain number of years can qualify, even if they aren’t 65 yet.

This often involves a combination of work history and potentially other factors. People with specific disabilities or end-stage renal disease may also qualify for Medicare benefits before reaching traditional retirement age.

Medicare Enrollment Periods

Understanding the different enrollment periods for Medicare is critical. The Initial Enrollment Period (IEP) is the window of time immediately before, during, and after turning 65, when you can sign up for Parts A and B. If you miss the IEP, you may still be able to enroll during the General Enrollment Period (GEP), though you might face potential premium penalties.

Additionally, there’s a Special Enrollment Period (SEP) for those with specific life events, such as a change in employment or a significant health event.

Impact on Cost Comparison

Medicare eligibility directly impacts the cost comparison with employer insurance. If you qualify for Medicare, the cost of your employer-sponsored insurance might become less relevant or even obsolete. Conversely, if you’re still working and under a company health plan, the cost of Medicare, as well as the cost of the employer insurance, plays a significant role in the decision-making process.

Figuring out if Medicare is cheaper than employer insurance depends on your situation, but honestly, it’s a complex calculation. You’ve got to weigh the premiums, deductibles, and co-pays of both. Looking at a menu like Juicy’s Famous Fair Food menu can help you see how costs can quickly add up if you’re not careful. Ultimately, crunching the numbers for your specific needs is key to deciding which option is best.

Juicys famous fair food menu provides a great example of how hidden costs can creep in. So, do your research and get the best deal for you!

This is where comparing the premium costs, deductibles, co-pays, and coverage options becomes critical. The specific eligibility requirements and enrollment periods influence the financial considerations of the healthcare choice.

Summary Table: Medicare Eligibility and Enrollment Periods

| Eligibility Factor | Description |

|---|---|

| Age | Generally, individuals aged 65 and older qualify. |

| Work History | Individuals who have paid into Social Security for a certain number of years can qualify, even if not 65. |

| Disability | Individuals with specific disabilities may qualify. |

| End-Stage Renal Disease | Individuals with end-stage renal disease may qualify. |

| Enrollment Period | Description |

|---|---|

| Initial Enrollment Period (IEP) | The window of time immediately before, during, and after turning 65, when you can sign up for Parts A and B. |

| General Enrollment Period (GEP) | Allows enrollment outside the IEP, but potential premium penalties may apply. |

| Special Enrollment Period (SEP) | Enrollment periods for specific life events, such as a change in employment or a significant health event. |

Factors Affecting Medicare Eligibility and Enrollment Periods

- Age: Age is a primary factor in determining eligibility for Medicare. Turning 65 often triggers the Initial Enrollment Period.

- Work History: The amount of time an individual has contributed to Social Security plays a role in eligibility, particularly for those under 65.

- Disability: Individuals with qualifying disabilities might be eligible for Medicare benefits before reaching traditional retirement age.

- End-Stage Renal Disease (ESRD): Those with ESRD, a serious kidney condition, can also qualify for Medicare before the typical age of eligibility.

- Enrollment Periods: The Initial Enrollment Period (IEP), General Enrollment Period (GEP), and Special Enrollment Period (SEP) dictate when individuals can enroll in Medicare. Missing the IEP might lead to increased costs later.

Employer Insurance Plans and Benefits

Employer-sponsored health insurance is a crucial aspect of employee compensation and benefits packages. Understanding the various types of plans, the typical benefits included, and how costs vary is vital for both employees and employers. This section delves into the intricacies of employer insurance plans, helping you navigate the landscape of health coverage options.Employer insurance plans are designed to offer a wide range of health care options, often at a reduced cost compared to purchasing coverage independently.

The specifics of these plans, however, can differ significantly, impacting the overall cost and benefits employees receive. This comprehensive look at employer-sponsored insurance will provide a detailed understanding of the factors that contribute to these variations.

Different Types of Employer-Sponsored Insurance Plans

Employer-sponsored insurance plans come in diverse forms, catering to various employee needs and budgets. Understanding these types is key to making informed decisions.

- Health Maintenance Organizations (HMOs): HMOs typically limit healthcare access to a network of doctors and hospitals. Preventive care is often emphasized, aiming to reduce the need for more costly treatments. This structured approach can lead to more predictable costs, but may limit choices in providers.

- Preferred Provider Organizations (PPOs): PPOs offer broader provider networks compared to HMOs. Patients have more flexibility in choosing doctors and hospitals, but out-of-network costs are often higher. This flexibility comes with the potential for greater costs, especially for complex procedures or care outside the preferred network.

- Point-of-Service (POS) Plans: POS plans blend elements of HMOs and PPOs. Patients generally have access to a network of doctors and hospitals, similar to an HMO, but may have some flexibility in using out-of-network providers. The costs depend on whether care is in-network or out-of-network.

- Exclusive Provider Organizations (EPOs): EPOs, similar to PPOs, provide a network of healthcare providers. However, EPOs typically do not cover services provided by out-of-network healthcare providers. This limited network may result in lower costs, but less flexibility in choosing providers.

Typical Benefits Included in Employer Insurance Plans

The benefits included in employer insurance plans vary considerably, depending on the plan type and the employer. These benefits frequently cover a range of medical services.

- Preventive Care: This often includes routine checkups, vaccinations, and screenings, reducing the likelihood of costly illnesses in the future. Examples of preventive care include mammograms, colonoscopies, and vaccinations for various diseases.

- Prescription Drugs: Most plans cover prescription medications, though coverage amounts and formulary restrictions may vary. Formulary restrictions mean certain medications might not be covered at all, or have very limited coverage.

- Mental Health Services: Increasingly, employer plans incorporate mental health services, recognizing the importance of mental wellness. This includes counseling, therapy, and other support services. The level of coverage can vary greatly across different plans.

- Vision and Dental Care: Some plans include vision and dental coverage, providing additional benefits beyond basic medical care. These benefits are not always standard across all employer insurance plans.

Variations in Coverage and Costs

Employer insurance plans can vary widely in terms of coverage and costs.

- Plan Deductibles and Co-pays: Deductibles are the amount you pay out-of-pocket before the insurance company begins to pay. Co-pays are fixed amounts you pay for specific services, like a doctor visit. These costs differ significantly between plans, influencing the overall cost for the insured.

- Coverage Limits: Insurance plans often have maximum limits on the total amount they will pay for medical care. This limit can be a significant factor for individuals with chronic illnesses or extensive medical needs.

- Network Availability: The geographic location and availability of providers within the insurance network affect the plan’s usability. A smaller network can mean fewer options for care, potentially increasing costs.

Impact of Employee Contributions

Employee contributions significantly impact the overall cost of employer insurance. Employee contributions typically reduce the overall premium costs borne by the employer.

- Premium Sharing: Many plans require employees to contribute to the premium costs, with employers often covering a portion. This sharing arrangement influences the final cost for both employees and employers.

Summary Table of Employer Insurance Plans, Is medicare cheaper than employer insurance

| Plan Type | Typical Benefits | Coverage Variations |

|---|---|---|

| HMO | Limited network, emphasis on preventive care | Lower premiums, but limited provider choice |

| PPO | Broader network, more provider choices | Higher premiums, potential for higher out-of-pocket costs |

| POS | Hybrid of HMO and PPO, some network flexibility | Moderate premiums, some flexibility in provider choice |

| EPO | Network of providers, no out-of-network coverage | Lower premiums, limited provider choices |

Cost-Effectiveness Analysis

Choosing between Medicare and employer-sponsored insurance involves a complex cost analysis that extends beyond the initial premiums. Long-term financial implications, influenced by individual health needs and future healthcare costs, are crucial considerations. This analysis delves into the potential cost differences over time, factoring in potential future healthcare requirements.Understanding the long-term cost implications is vital for informed decision-making. Predicting future healthcare costs is challenging, yet crucial to evaluating the financial burden of each option.

Factors like increasing medical technology, evolving treatment methods, and potential chronic conditions all contribute to the dynamic nature of healthcare costs.

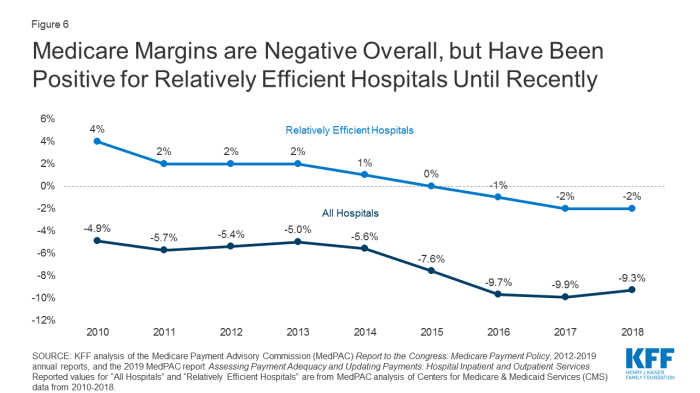

Long-Term Cost Implications of Medicare

Medicare’s structure, with its fixed premiums and cost-sharing, offers a predictable monthly expense. However, the out-of-pocket costs for specific services like prescription drugs, dental care, and some therapies can accumulate. Medicare Advantage plans, while offering wider coverage options, can also involve higher premiums and potentially more complex cost structures. The overall cost depends significantly on the specific Medicare plan chosen.

Long-Term Cost Implications of Employer Insurance

Employer insurance plans typically feature a mix of premiums, deductibles, and co-pays. The specific costs depend on the plan’s design and benefits package. While premiums might be lower compared to Medicare, deductibles and co-pays can increase significantly when utilizing healthcare services. The rising costs of medical procedures and prescription medications can lead to substantial out-of-pocket expenses over time.

Impact of Future Health Needs

The potential for future health needs significantly impacts the cost of both options. For individuals with pre-existing conditions or a family history of chronic diseases, the long-term costs of employer insurance might become substantial due to higher out-of-pocket expenses. Similarly, unexpected illnesses or injuries can lead to unexpected financial burdens under employer insurance, often requiring significant upfront payments.

Medicare, with its fixed monthly premium, may be more predictable in these situations, but the cost-sharing for certain services still applies.

Financial Implications of Choosing One Option Over the Other

Scenario 1: A healthy individual with no significant pre-existing conditions might find employer insurance more cost-effective in the short term. However, if that individual experiences a serious illness or injury, the out-of-pocket costs can rapidly escalate.Scenario 2: An individual with a pre-existing condition or a family history of chronic illness might find Medicare’s fixed monthly premium more predictable and potentially less expensive in the long run.

However, the cost-sharing for certain services and potential lack of coverage for some specific needs could lead to unexpected expenses.

Visual Representation of Long-Term Cost Comparison

A hypothetical graph illustrating the long-term cost comparison of Medicare and employer insurance plans would show an initial cost difference based on premiums. Over time, the employer insurance costs could fluctuate based on utilization of healthcare services, whereas Medicare costs remain relatively consistent, though with cost-sharing adjustments. The graph would highlight the impact of potential future health needs on the overall cost, emphasizing the unpredictable nature of employer insurance costs compared to the fixed monthly premiums of Medicare.

The graph would also showcase the potential for significant savings under Medicare if a person requires substantial healthcare services.

Closing Notes

Ultimately, determining whether Medicare or employer insurance is the more cost-effective option hinges on a thorough assessment of individual needs, health conditions, and financial situations. Understanding the specific coverage and costs associated with each plan is vital for making an informed decision. This analysis offers valuable insights for those considering their healthcare options.

Question & Answer Hub: Is Medicare Cheaper Than Employer Insurance

What are the common factors that affect the cost of Medicare plans?

Medicare costs are influenced by factors such as the chosen plan, premiums, deductibles, and co-pays. The specific services covered, the individual’s health status, and any pre-existing conditions can also affect the overall cost.

How do employer-sponsored insurance plans typically vary in coverage and cost?

Employer insurance plans can vary significantly in coverage and cost based on factors such as the size of the employer, the employee’s location, and the selected plan. Employee contributions and benefit packages also influence the final cost.

What are the specific services where coverage might be limited in Medicare versus employer insurance?

Medicare may have limited coverage for certain services, such as certain types of dental or vision care, or some advanced medical procedures that might be more comprehensively covered by employer insurance.

What are the enrollment periods and deadlines for Medicare?

Medicare enrollment periods and deadlines are specific to each individual’s circumstances. It’s essential to consult official Medicare resources for detailed information on these periods and deadlines.