Travelers high value home insurance provides specialized coverage for properties with high-value contents and potential risks. This comprehensive guide delves into the specifics, from defining the policy to navigating claims and understanding current trends. It highlights the key distinctions from standard home insurance, and covers the essential steps in selecting the right policy and managing claims effectively.

Protecting valuable assets requires a tailored approach. This guide will walk you through the essential aspects of travelers high value home insurance, enabling you to make informed decisions to safeguard your home and its contents.

Defining Travelers High Value Home Insurance

Yo, peeps! So, you’ve got a seriously awesome pad, right? Maybe it’s decked out with designer everything, or filled with priceless heirlooms. This ain’t your average joe home insurance; we’re talkin’ Travelers High Value Home Insurance, which is totally different from regular policies. It’s like, extra protection for extra-cool digs.This policy is totally customized to handle the unique risks and needs of homes with high-value items.

It’s not just about replacing your couch; it’s about covering the whole shebang, from the antique grandfather clock to the custom-built entertainment system. It’s like having a superhero for your house, ready to swoop in and save the day if something goes sideways.

Key Characteristics and Features

Travelers High Value Home Insurance goes way beyond basic coverage. It’s designed to handle specific risks that standard policies often overlook. Think about things like specialized equipment, high-end electronics, and valuable collectibles. This insurance digs deep into the specifics of your home’s contents and provides a tailored protection plan.

Distinguishing Features from Standard Policies

Standard home insurance is, like, basic. Travelers High Value Home Insurance is totally different. It’s like comparing a ramen noodle to a gourmet meal. It includes higher coverage limits, specifically for high-value items, potentially including extra coverage for things like specialized equipment, high-end appliances, and unique collections. Also, it often has a more detailed appraisal process for accurate assessments.

It also usually offers more comprehensive coverage for perils like theft, vandalism, or natural disasters.

Comparison with Other Specialized Home Insurance Types

This insurance is different from high-end, luxury, or antique policies, which usually focus on specific categories of high-value items. Travelers High Value Home Insurance, however, is a more general approach, providing comprehensive coverage for the entire home. Think of it as a general protection plan for the house as a whole. A high-end policy might only cover specific designer furniture, while this one covers the whole house, including all the stuff in it.

Specific Risks and Vulnerabilities Covered

This type of insurance is built to protect against a wide range of risks. Think extreme weather events like hurricanes or earthquakes, or even something like a fire or a water leak. It’s about protecting against things that standard policies might not cover as thoroughly, like damage from a rare flood, or a catastrophic fire, or even a professional-level break-in.

Plus, it usually covers the cost of professional cleanup and restoration after a major incident.

Common Types of Properties Requiring This Coverage

This coverage is perfect for homes with significant investments in valuable assets. Think of homes with high-end art collections, antique furniture, or custom-built audio-visual systems. It’s also a great option for those with luxury vehicles, boats, or other expensive possessions stored on the property. Basically, if your house has something worth a lot of dough, this policy is a must.

Homes with historic features, unique architecture, or custom-built features might also need this type of coverage.

Coverage Components

Yo, so you wanna protect your crib, right? High-value homes need extra insurance, like, major extra. This section breaks down the deets on what’s covered and what’s not.This is crucial stuff, fam. Knowing your coverage is key to avoiding major headaches if something goes down. It’s like having a safety net for your whole house, your stuff, and you.

Typical Coverage Components

This table Artikels the usual components of high-value home insurance policies. Basically, it’s a checklist of the stuff that’s usually protected.

| Coverage Component | Description |

|---|---|

| Dwelling Coverage | Protects the structure of your house against things like fire, storms, and vandalism. |

| Personal Property Coverage | Insures your belongings – furniture, electronics, clothes, and more – against damage or theft. |

| Liability Coverage | Protects you if someone gets hurt on your property or if your stuff damages someone else’s property. |

| Additional Living Expenses (ALE) | Covers expenses if you have to live elsewhere while your house is being repaired after a covered loss. |

Exclusions

These are the things that your policywon’t* cover. It’s important to know what you’re not covered for so you’re not surprised later.

| Exclusion | Explanation |

|---|---|

| Wear and Tear | Normal deterioration of your belongings over time. |

| Earthquakes and sinkholes (sometimes) | Many policies exclude earthquakes and sinkholes, but some high-value policies might have options to add coverage. It really depends on the policy. |

| War | War-related damages aren’t typically covered. |

| Nuclear events | Nuclear events are usually excluded, but high-value policies may have some wiggle room. |

| Flooding | Flooding is often excluded, but you can often add flood insurance as a separate policy. |

Coverage Levels

Different policies offer different levels of protection. You can customize your policy to fit your needs.

- Replacement Cost: This covers the cost to replace your stuff, even if it’s older or outdated. It’s better than actual cash value. Think about a vintage guitar that’s totally destroyed, or something. You can replace it with a similar one.

- Scheduled Items: If you have super valuable stuff like art or jewelry, you can list them on a schedule in your policy. This lets the insurance company know how much your stuff is worth and helps them protect it better. This is key if your valuables are extremely expensive.

Valuable Belongings

This section is for high-value items like jewelry, art, and antiques.

- Jewelry: Policies often have special coverage limits for jewelry. You might need to list your items and get appraisals. This is super important because a ring or a necklace might be more valuable than a piece of furniture.

- Art and Antiques: Similar to jewelry, these often require special documentation and appraisals to determine the value.

Policy Tiers

Different tiers of high-value home insurance policies offer varying coverage amounts and deductibles. Your coverage depends on your policy.

| Policy Tier | Coverage Amount (Example) | Deductible (Example) |

|---|---|---|

| Basic | $500,000 | $2,500 |

| Premium | $1,000,000 | $5,000 |

| Luxury | $2,000,000+ | $10,000+ |

Policy Selection and Evaluation

Picking the perfect high-value home insurance policy is crucial, like choosing the hottest new phone. You gotta make sure it’s got all the bells and whistles to protect your crib from total disaster. This ain’t your average home insurance; we’re talking serious dough, so you need a policy that’s just as serious.Evaluating your home’s unique risks is key to getting the right coverage.

Think of it like a personal risk assessment, but instead of your social media feed, it’s your house. Knowing your home’s vulnerabilities helps you get the right protection and avoid unnecessary premiums.

Factors to Consider When Choosing a Policy

Choosing the right policy involves looking at more than just the price tag. You need to consider factors like your home’s location, its construction, and any unique features. A beachfront mansion in Florida needs different coverage than a cozy cabin in the mountains.

- Location: Flooding, earthquakes, or wildfires are all risks that can vary greatly by location. Coastal properties are more vulnerable to storms, while areas prone to earthquakes need specialized coverage.

- Construction Materials: Older homes or those with unique materials might have different vulnerabilities than modern builds. A home with a historic wooden structure might need extra protection against fire or water damage. Also, the value of your home’s contents will play a major role.

- Unique Features: High-end features, like a custom art collection or a top-of-the-line sound system, need special attention. These items are worth a fortune, so their protection needs to be equally valuable.

- Coverage Limits: Understanding the policy limits is vital. If your valuables are worth a small fortune, you need to ensure the policy can cover the potential loss. It’s not just about the house; it’s about everything inside.

Evaluating Property Vulnerabilities

Knowing your home’s weaknesses is like having a secret weapon. It allows you to customize your coverage and avoid paying for unnecessary protection.

- Geographic Hazards: Flooding, wildfires, earthquakes, or hurricanes all have different risk levels in various areas. For example, a house near a river is more susceptible to flooding than a house in the desert.

- Structural Weaknesses: Assess the condition of your home’s foundation, roof, and other structural elements. A home with a weak roof might be more prone to damage during a storm.

- Security Risks: Burglary, theft, or vandalism are all serious threats to your home and possessions. Homes with easy access points or those in high-crime areas might need additional security measures.

Essential Questions for Insurance Providers

Asking the right questions is key to getting the best possible policy. These questions will help you ensure the coverage fits your needs and helps you avoid costly mistakes.

- Specific Coverage Limits: What are the specific limits for different types of damage, like fire, theft, or water damage?

- Exclusions and Limitations: What types of risks are excluded from coverage? Do you have to pay extra for specialized items or collections? It’s important to ask about exclusions so you’re not blindsided later.

- Claims Process: What is the claims process like? How long does it take to get your claim settled?

- Premium Options: How can you negotiate the premium amount based on your needs? Shop around for the best deal.

Importance of Obtaining Multiple Quotes

Getting multiple quotes from different providers is like having a whole bunch of different opinions about your policy. You can compare prices, coverage, and service to find the best fit for your home.

- Price Comparison: Comparing prices from different insurers can save you a ton of cash. It’s like finding the best deal on a new video game.

- Coverage Comparison: Different insurers have different coverage options. Comparing these options helps you find the best fit for your needs.

- Provider Reputation: Look into the reputation of each provider. Read reviews and see how other customers have been treated.

Comparing and Evaluating Policy Options

Comparing policy options involves carefully evaluating the details of each policy. You need to make sure it’s the perfect match for your high-value home.

- Review Policy Documents: Carefully review the policy documents to understand the coverage and exclusions. Don’t just skim it; read every word.

- Consider Deductibles and Premiums: Deductibles and premiums are key financial aspects. Evaluate which policy has the best balance.

- Assess Coverage Adequacy: Make sure the coverage adequately protects your home and valuables. It should be a no-brainer that you get the right coverage.

Current Trends and Future Outlook

Yo, peeps! High-value home insurance is totally evolving, and it’s not just about fancy new policies. It’s about keeping up with the latest tech, staying safe, and figuring out how to keep your crib protected in the future. It’s all about staying ahead of the curve, ya know?This ain’t your grandma’s insurance. It’s way more complex now, with tons of factors like climate change, tech advancements, and even social trends impacting how much and what kind of coverage you need.

We’re gonna break down the current trends and what’s coming next, so you can totally crush it when it comes to your home’s protection.

Current Trends in the High-Value Home Insurance Market

The high-value home insurance market is seeing some major shifts. People are buying bigger, more expensive homes, and they want more comprehensive coverage to match. This means insurance companies are responding by offering specialized policies with more customization options and focusing on preventative measures. Luxury items and high-tech features are becoming more prevalent, and insurance policies are adapting to better cover these unique risks.

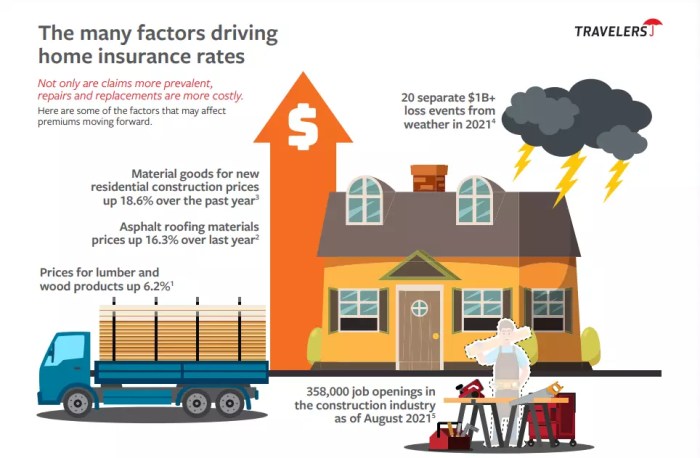

Potential Future Developments and Challenges

The future of high-value home insurance is looking pretty wild. Climate change is a major factor, and insurers are having to account for increased risk from things like wildfires, floods, and severe weather events. This is pushing insurance costs up, and it’s going to get even tougher to get coverage in certain areas. New tech like smart home systems and automated security systems are changing how we protect our homes, but also introduce new vulnerabilities.

Travelers high-value home insurance often necessitates a detailed inventory, encompassing valuable items like jewelry and antiques. A comparable level of meticulous record-keeping is crucial when evaluating potential risks associated with preparing a seasonal beverage like the Jamba Juice Pumpkin Smash, a recipe available here. Ultimately, comprehensive risk assessments, whether for home insurance or crafting a delicious beverage, are essential for optimal outcomes.

Companies need to keep up with these changes, or risk losing customers to competitors.

Impact of Technological Advancements

Tech is totally transforming how we think about high-value home insurance. Smart home devices can provide real-time data on the condition of your property, potentially leading to lower premiums for those who use preventative measures. However, these systems also open up new vulnerabilities. Hackers could potentially exploit these systems to gain access to your home or cause damage.

Insurance companies need to find ways to integrate this tech into their policies while still safeguarding against the potential risks.

Travelers high-value home insurance policies often cover various damages, including those to exterior components. However, determining whether such coverage extends to incidents like bumper damage hinges on specific policy stipulations. For example, understanding if your policy covers damage to exterior elements like bumpers requires careful review of the policy’s terms, and researching whether insurance covers bumper damage in general, can help you determine if your policy will cover such a claim.

does insurance cover bumper damage Ultimately, comprehensive knowledge of the policy’s provisions remains crucial for travelers with high-value homes.

Role of Preventative Measures

Taking preventative measures is key to reducing insurance costs. Things like installing security systems, fire alarms, and maintaining your home’s structure can significantly reduce the risk of damage. Insurers are starting to reward these proactive homeowners by offering discounts and better coverage options. This is a win-win: you save money, and your home is safer.

Future Considerations for High-Value Home Insurance Policyholders

- Staying informed about climate change risks in your area is crucial. This includes understanding potential flood zones, wildfire danger zones, and other weather-related hazards. Knowing these factors can help you take proactive steps to protect your home.

- Regularly reviewing and updating your policy to reflect changes in your home’s value, features, and location is a must. If you add a pool or a fancy security system, make sure your coverage is adjusted accordingly.

- Actively participating in preventative measures like home maintenance and security upgrades can significantly lower your premiums. This is a smart way to protect your investment and save money.

- Understanding the coverage limits and exclusions in your policy is super important. This includes understanding what’s covered and what isn’t, like damage caused by specific weather events or by certain high-tech systems. Knowing this upfront can prevent surprises later on.

Illustrative Case Studies

Yo, peeps! High-value homes, right? They’re awesome, but they come with a lotta responsibility, especially when it comes to insurance claims. We’re gonna dive into some real-life scenarios, showing how claims get handled, and what to expect. It’s all about the deets, fam.

A High-Value Home Insurance Claim

This case study focuses on a luxury beachfront mansion valued at $10 million. The homeowners, the “Jones” family, had comprehensive Travelers High Value Home Insurance. The property boasted custom-built features, high-end finishes, and a state-of-the-art security system. It was a total dream home, but dreams can have unfortunate hiccups.

Property Characteristics and Damage

The mansion, built on a beachfront property, experienced a devastating hurricane. Sustained damage included significant structural damage to the foundation, roof collapse, and water damage throughout the interior. High-end furnishings and artwork, valued at over $500,000, were severely damaged or destroyed. Basically, the hurricane turned the mansion into a total wreck.

Claim Resolution Steps

The Jones family filed a claim immediately after the storm. Travelers’ claims adjusters assessed the damage, using advanced drone photography and 3D modeling. Independent engineers were brought in to inspect the structural damage and develop a detailed restoration plan. The process involved several meetings with the Jones family, providing updates and keeping them in the loop. Insurance companies had to ensure that everything is done according to the policy, in accordance with the state and federal laws, to avoid any issues or problems.

Claim Handling Insights

Travelers’ handling of the claim was exemplary. The communication was prompt and professional, with regular updates provided to the Jones family. They were involved in every step of the claim process, and their concerns were addressed promptly. The restoration was handled by a reputable contractor, ensuring high-quality work and adherence to the restoration plan. They really went above and beyond, showing a dedication to helping the family get back on their feet.

Detailed Claim Process Report

| Stage | Action | Timeline |

|---|---|---|

| Claim Filing | Jones family submitted a comprehensive claim report | Day 1 |

| Damage Assessment | Travelers’ adjusters and independent engineers assessed the damage | Days 2-5 |

| Restoration Plan | Detailed restoration plan developed | Day 6 |

| Contractor Selection | Reputable contractor selected for restoration work | Day 7 |

| Restoration Work | Restoration work commenced | Days 8-30 |

| Claim Settlement | Travelers settled the claim in accordance with the policy | Day 30 |

The report details every step in the process, ensuring a smooth and efficient claim resolution for the Jones family. They were treated fairly and respectfully throughout the entire ordeal. It’s important to remember that every claim is unique, but with a solid insurance policy, you can recover from major damage and get back to enjoying your home.

Property Valuation and Assessment: Travelers High Value Home Insurance

Yo, peeps! Figuring out the real worth of your mega-mansion is crucial for high-value home insurance. It’s like, totally avoiding a major bummer if your place gets toasted by a wildfire or a rogue squirrel starts a total house fire. Proper valuation ensures your policy reflects the actual price tag of your digs, so you’re covered for the real deal.

Methods for Accurately Assessing Value, Travelers high value home insurance

Different methods exist for determining the value of a high-value home. It’s not just about eyeballing it; you gotta get into the nitty-gritty details. Market analysis is key, looking at recent sales of similar homes in the area. Comparable sales, or comps, are the go-to for a fair assessment. Appraisers use these comps to determine a range of likely values.

You can also consider replacement cost, which estimates the cost of rebuilding the home from scratch, factoring in current material costs and labor rates.

Role of Professional Appraisers

Professional appraisers are the real MVPs in this process. They’re the experts who bring the knowledge and tools to accurately assess property value. They meticulously inspect the property, inside and out, evaluating structural integrity, quality of materials, and any necessary repairs. They are like the detectives of property value, meticulously researching and analyzing to arrive at a fair estimate.

Steps in Conducting a Comprehensive Property Valuation

A comprehensive valuation involves several steps. First, the appraiser researches comparable sales and market trends in the area. Next, they conduct a physical inspection, assessing the condition of the property, noting any needed repairs or updates. They also evaluate the property’s location and surrounding amenities, considering factors like proximity to schools, parks, and transportation. Finally, they consider the replacement cost of the home, including materials, labor, and permits.

All these factors are meticulously considered and documented to form the final valuation.

Evaluating Specific Items Within the Property

Evaluating individual items within a high-value home requires specific attention. For example, unique artwork, antique furniture, or custom-built features need separate valuation. Specialized appraisers, like art or antiques specialists, are necessary for accurately assessing the worth of these items. They meticulously examine the piece’s condition, origin, and historical significance. Sometimes, they even get involved with authentication to ensure the item’s authenticity.

Insurance companies rely on this type of specialized valuation to ensure a fair and accurate coverage amount for valuable items.

Case Study: The Importance of Accurate Property Valuation

A wealthy homeowner, let’s call him Mr. Smith, had a stunning, custom-built home with an impressive art collection. He underestimated the value of his home during the initial insurance policy purchase. When a devastating storm damaged his home and caused significant water damage, his insurance claim was significantly lower than the actual cost of restoration and replacement. Mr.

Smith’s inaccurate property valuation led to him not being adequately covered for the repairs and the art collection. This highlights the importance of accurate property valuation to ensure adequate coverage for the true worth of the property. A proper assessment prevents costly surprises down the road.

Ultimate Conclusion

In conclusion, travelers high value home insurance is a critical aspect of safeguarding high-value properties. Understanding the specific coverage, policy selection process, and claim procedures is paramount. This guide has Artikeld the key elements, empowering you to make informed choices and ensure comprehensive protection. Remember to consult with insurance providers to assess your specific needs and obtain personalized advice.

FAQ Guide

What are some common exclusions in a high-value home insurance policy?

Exclusions can vary by provider, but common examples include damage from wear and tear, neglect, or intentional acts. Always review the policy details carefully for specific exclusions.

How do I evaluate my property’s specific vulnerabilities?

Evaluating vulnerabilities involves assessing factors like location (flood zones, earthquake risks), construction quality, and potential security threats. A professional risk assessment can be helpful.

What are the different levels of coverage options for valuable belongings?

Options include replacement cost, scheduled items (with specific valuations), and agreed value. The level of coverage will affect the amount paid in case of a claim.

What are the steps involved in filing a claim for damage?

Contact your insurance provider immediately, document the damage thoroughly (photos, videos), and cooperate with the assessment process. Follow the specific instructions provided by your insurer.